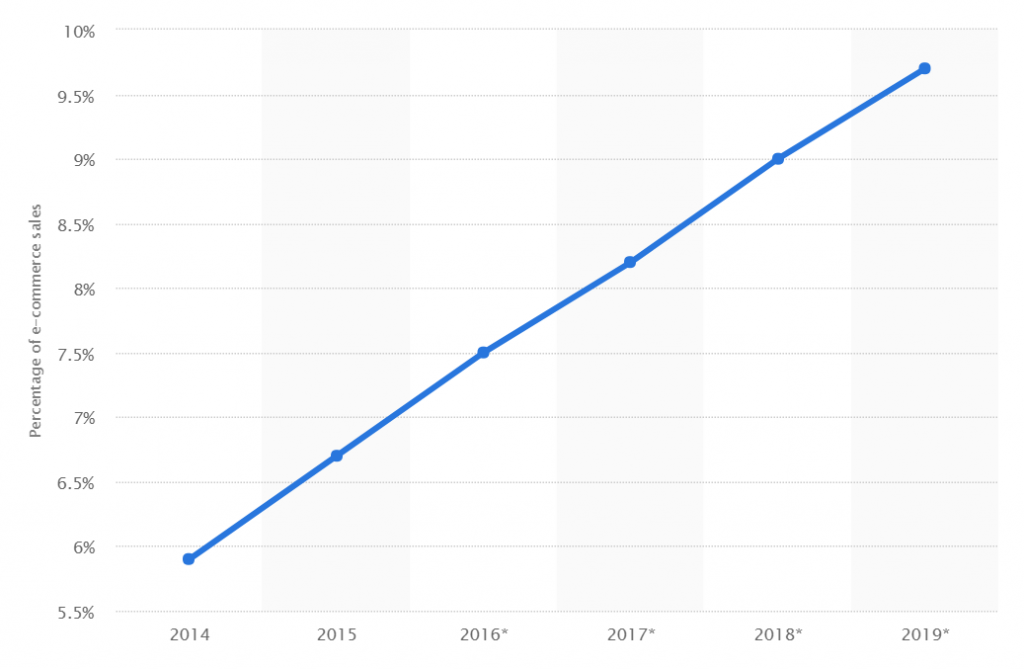

The late but rapid rise of e-commerce has caused many to predict the slow decline of traditional bricks and mortar stores across Japan.

This rise of ecommerce is set to continue, with JapanConsuming, an online publication devoted to the Japanese retail industry, predicting that the percentage of retail sales will rise from 9% to 23% by 2023.

When the coronavirus disease 2019 (COVID-19) hit Japan, the country’s department store sales declined across the board. Since the government declared a state of emergency in the country last April, many businesses and shops were left with no choice but to limit or even stop operations. Given the situation, sales plummeted down to about 72.8 % in April 2020 and 65.5 % in May The Japan Department Stores Association reported that sales of 203 outlets run by 73 operators amounted to ¥383 billion ($3.5 billion), marking its ninth straight month of decline.

As the emergency declaration was lifted in mid-May 2020, sales improved with only about a 19.1% decline on purchases. The Japanese community has been urged to lessen movement and follow the new normal lifestyle until a vaccine or therapeutic drug is discovered.

Experts in Japan’s distribution industry see potential in online operations in this difficult time. This leads to growth in the influence of Omnichannel marketing in Japan.

Omnichannel marketing in Japan

Omnichannel marketing is essentially the need for marketers to provide a seamless experience, regardless of channel or device.

Consumers need to be able to engage with a company across all platforms including their physical store and their online presence.

CEO of JDA Software, Baljit S. Dai Lot sums it up nicely;

“Digital and mobile are enhancements to brick-and-mortar. They’re not a separate channel.”

This is especially true in Japan where consumers view shopping expeditions as a sort of pilgrimage.

The key strategy for retail marketers in Japan is to build on this pilgrimage view on shopping.

The Ecommerce Foundation’s report on Japan published by Webhelp Group details that in order to create a strong retail brand to which consumers will return, they must turn shopping into retail therapy — effortless, relaxing and ultimately enjoyable.

This is achieved by the omnichannel approach.

The Muji experience

Perhaps the best Japanese example of this is Muji. Muji is a Japanese retail company that specializes in a variety of household and consumer goods, distinguished by its design minimalism, emphasis on recycling, and avoidance of waste.

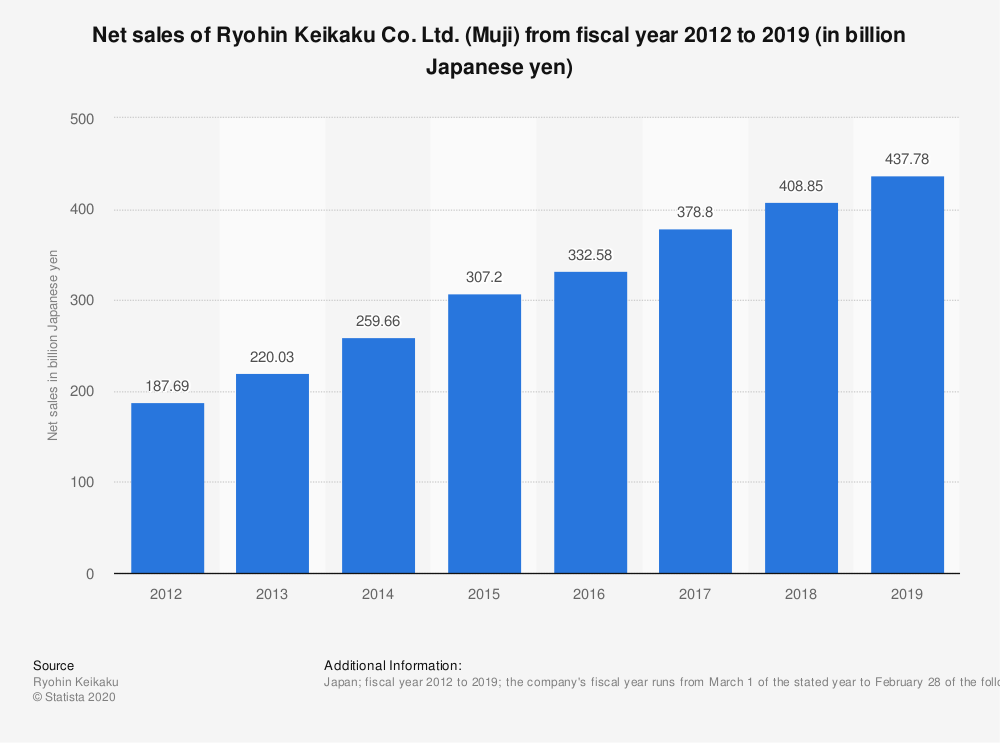

In addition to over 437 retail stores across Japan as of 2019, Muji also utilizes a mobile sensitive website and a mobile application that allows consumers to check stock items in each store and offers consumers personalized product recommendations on their mobile devices.

Furthermore, Muji has successfully implemented social media as a channel for sales growth— with 8.3% of customers making purchases as a direct result of social media posts in the year 2018.

This is made even more remarkable by the fact that Muji’s most prominent social media platform is Instagram, which was recently listed as one of the top-performing social media platforms as of February 2020 in Japan.

Highlighting their true omnichannel nature, Muji’s head of corporate planning, finance and IT— Kenji Takeuchi stated that: “The number of customers that visit our shops is a KPI for our ecommerce division.”

This omnichannel strategy has allowed Muji to post consistent sales growth year on year since 2012.

Muji Profit Growth 2012-2019

The characteristics and opportunities of the Japanese market

Muji’s success was on the back of key market research.

The company identified that Japan has the highest digital buyer percentage in the Asia-Pacific.

This information allowed Muji to implement an omnichannel strategy that capitalized on areas of market growth.

The Japanese market however has other characteristics in which digital marketers can capitalize on in their omnichannel strategies.

One key characteristic is Japan’s urbanization.

Approximately 92% of the total population (127.6 million) is urban, giving it the highest urban population of the top 10 eCommerce markets.

The impact of this is that consumers want fast, seamless delivery of their products.

This has led to the rise of “Click and Collect” services within Japan.

An example of Japan’s urbanization is the existence of over 56,000 convenience stores (known as konbini), most of which are opened 24 hours a day.

The konbini offers a unique, convenient, and cost-effective way to deliver and pick up a package.

This strategy has proven to be successful with online retail giants Amazon but also niche services like Yamato Transport’s “Konbini to Course” golf club delivery service.

The need for cash

Ecommerce in Japan is especially mobile, with half of all transactions being conducted via mobile devices.

This offers a unique vantage point for slick omnichannel campaigns, such as Muji’s. Interestingly, however —there are 6,256 Japanese publishers on Google Play and 896,314 global publishers had an app that allowed Japanese consumers to purchase their goods or services.

This is reflective of the broader economy with alternative mobile payment methods failing to take off, with cash remaining to be king.

This emphasizes the need for an effective omnichannel strategy when marketing in Japan.

According to Hootsuite’s We Are Social Digital 2020 in Japan report, 66% of online purchases were paid with a credit card, making this the top mode of payment in e-commerce purchases in Japan. Other modes of payment for e-commerce purchases are via cash, bank transfer, and e-wallets.

Offering customers varying ways to pay for their purchases online is a core aspect of omnichannel marketing in japan.

LINE and omnichannel marketing

Exploiting Japan’s most popular social media platform— LINE, is another key strategy for omnichannel marketers.

Unlike their messaging application counterparts in the west, LINE has been able to connect businesses directly to their consumers by allowing businesses to create official accounts for a fee, and to then send information and free promotional stickers to subscribed users.

LINE also offers a reward card feature enabling users to collect points or stamps at their favorite stores using the LINE app.

Furthermore, LINE also offers its own store in which partners can advertise their products to a targeted audience.

Consumers can contact the business directly for inquiries using the chat function for any of these services.

This creates a seamless integration between user and business, presenting many opportunities for multichannel marketers.

According to Hubspot, nearly one in three c-commerce (conversational commerce) buyers say they chat with businesses in order to determine if they’re trustworthy and credible and at the same time approximately 57.1 million of Japan’s internet users are expected to access Line monthly—it is clear that LINE plays a pivotal role in the omnichannel marketing needs for Japanese businesses.

Both forms of the retail experience are vital in the Japanese market.

In order to be a successful Japan business, you must take advantage of both.

Seamless integration between the tangible and the digital is the key to growth.

Whether that is utilizing apps, konbini, cash payments or LINE, omnichannel marketing is sure to solidify businesses for the future.

Contact Info Cubic Japan today to optimize your omnichannel marketing strategy.

Featured Photo by Matthew Kwong on Unsplash