Japan is the third-largest market in the world, representing about 10% of the world’s economy. As of March 2021, Japanese stocks have become the best-performing share market in Asia, according to Bloomberg. The country recently surpassed Taiwan as Asia’s top market for the year. The time couldn’t be any more perfect for a company to establish their efforts for digital marketing in Japan.

With 126.3 million people, Japan is lucrative for any local and international businesses looking to expand. However, many foreign companies find the challenges of marketing here to be quite intimidating. For one, there are certain complexities in traditional Japanese marketing and advertising that require solid local knowledge.

If you’re looking to gain exposure and traction in the Land of the Rising Sun— you’d better study effective market entry thoroughly. It is essential to formulate a localized marketing plan focusing on brand identity, public relations, digital or online media, and your brand value.

This article will discuss an overview of the Japanese marketing scene and effective digital marketing strategies to help you start.

The Digital Landscape of Japan

With over 80% of Japan’s population being active social media users, businesses must have a firm grasp on the country’s current digital landscape. Knowing these insights will help you effectively target the local Japanese audience and monitor the next social media trends in the following years.

Let’s take a closer look at a general overview of digital and online media usage in Japan.

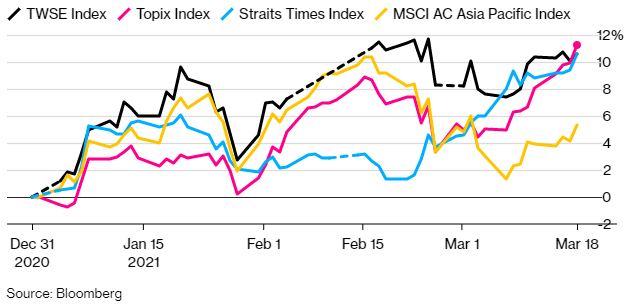

Digital Around The World

Source: https://datareportal.com/reports/digital-2021-japan

The global population continues to grow around 7.83 billion this year, 2021. The unique mobile users increased to 5.22 billion users compared to last year, approximately 5.19 billion. With the increase in internet users globally, digital growth will continue to grow as internet user penetration reaches 4.66 billion. The active social media users get 4.20 billion this year.

After understanding the digital world, marketers will help plan their marketing strategy to reach globally and target their audience that matches their marketing intent.

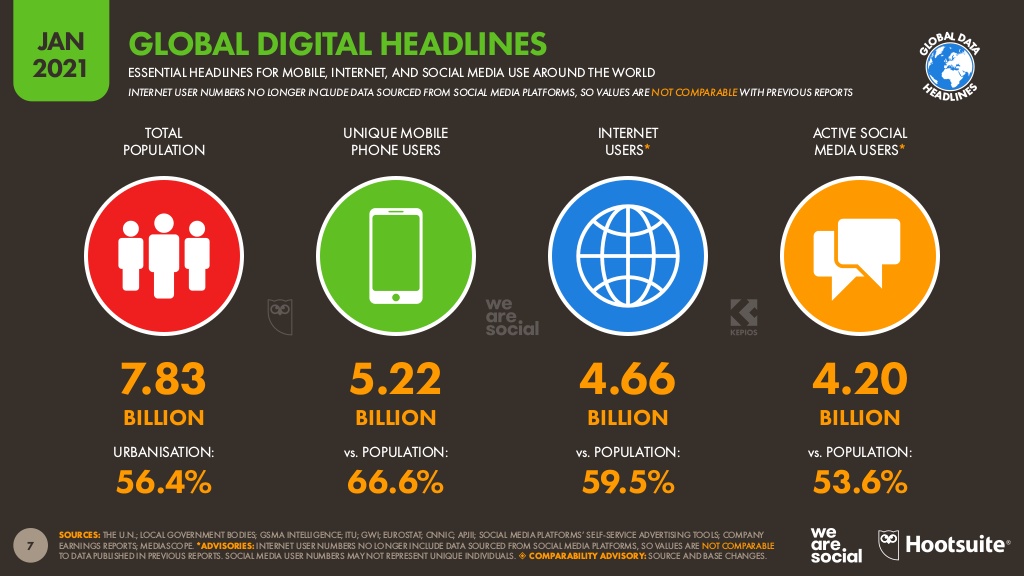

Overview of Internet Use

Source: https://datareportal.com/reports/digital-2021-japan

There are currently a total of 117.4 million internet users in Japan. In particular, 83.1% access the internet through mobile devices. Businesses looking to enter the Japanese market must also focus on advertising through mobile devices, such as tablets and smartphones.

The number of internet users in Japan comprises 93% of the total population, with the average Japanese person spending about 4 hours and 25 minutes on the internet daily.

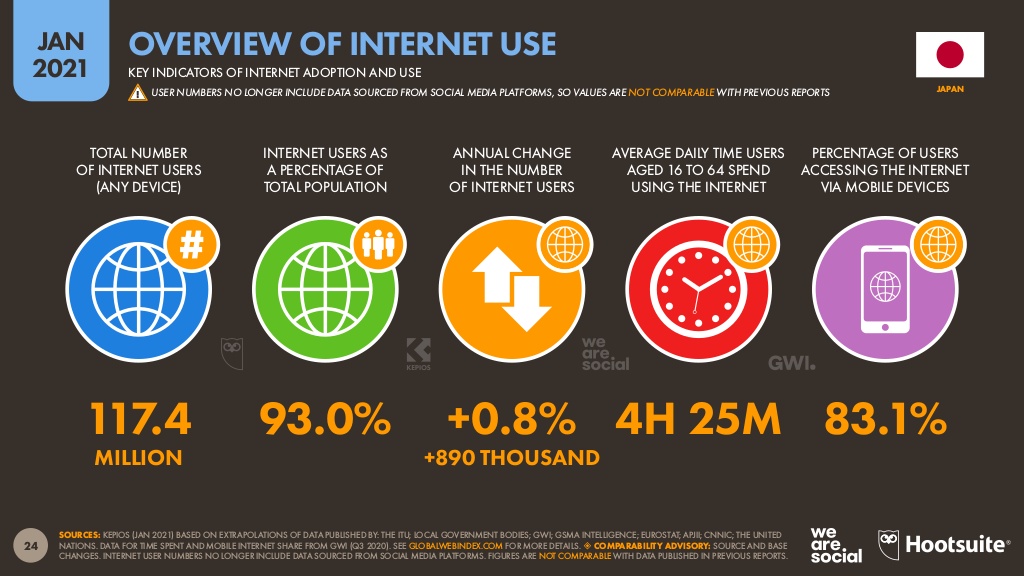

Daily Time Spent with Media

Source: https://datareportal.com/reports/digital-2021-japan

How does a typical internet user in Japan spend 4 hours and 25 minutes of daily internet use on different kinds of online media and devices?

The average Japanese spends about 2 hours and 21 minutes watching television (broadcasts and streaming), 51 minutes using social media platforms, 41 minutes reading press media (online and physical print), and 34 minutes playing video games on a gaming console.

When it comes to audio and musical media, they spend an average of 28 minutes listening to music streaming services, 29 minutes listening to broadcast radio, and 11 minutes listening to podcasts.

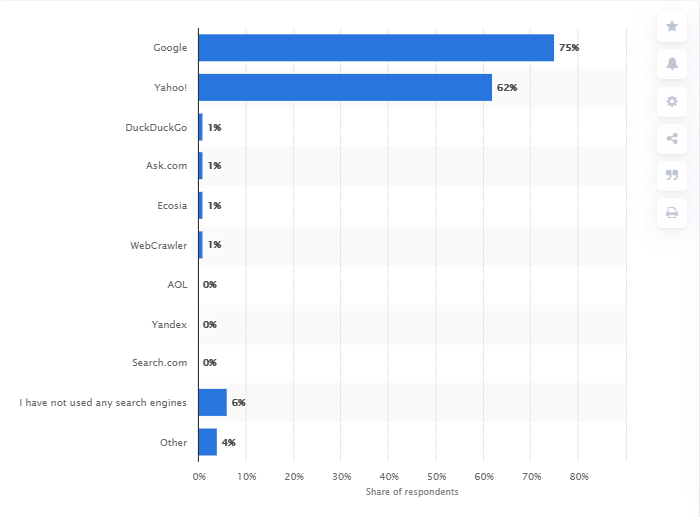

Search Engine Usage

According to the Statista Global survey conducted in Japan in 2020, most Japanese internet users use Google as their primary search engine at 75%, followed by Yahoo! Japan at 62%. Others who don’t use search engines are around 6%.

Businesses can use Google, the country’s most popular search engine platform, for marketing their products or services in Japan. Planning your digital marketing strategies will help your business reach a wider audience and establish brand identity in the Land of the Rising Sun.

Online Search Behaviors

Source: https://datareportal.com/reports/digital-2021-japan

Recent data on Japanese online search behavior showed that 97.5% of internet users used a conventional search engine in general, and 17.8% used voice search or voice command. Meanwhile, 26.2% use social media as their source when researching brands, and 9.6% use recognition tools on their mobile devices when conducting an online search.

With this data, marketers can adjust their marketing approach and strategy accordingly. The online search behaviors of most internet users in Japan will also help businesses create their marketing goals in the country.

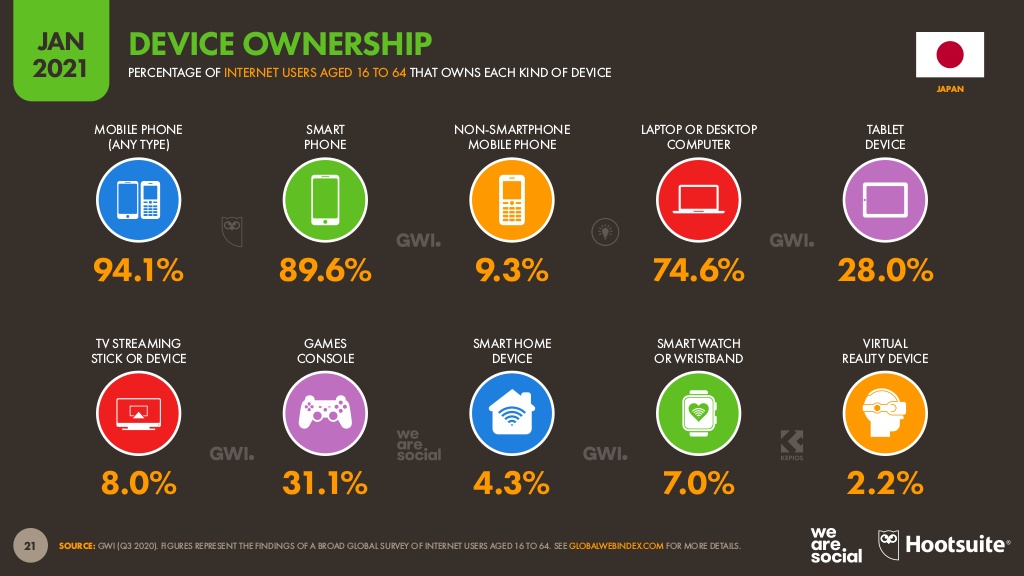

Device Ownership

Source: https://datareportal.com/reports/digital-2021-japan

When it comes to most used devices, 94.1% of Japanese people own mobile devices of any type, with 89.6% specifically using a smartphone device. With Japan’s mobile phone culture, businesses planning to enter the Japanese market must develop mobile-focused marketing strategies.

Notably, some users still use non-smartphone devices at 9.3%, with 74.6% of Japanese people owning laptops or desktop computers. Users with tablet devices are around 28.0% and gaming consoles at 31.1%.

Digital marketers can reach Japanese users on different devices through efficient planning and designing mobile-friendly websites and apps for their target audience.

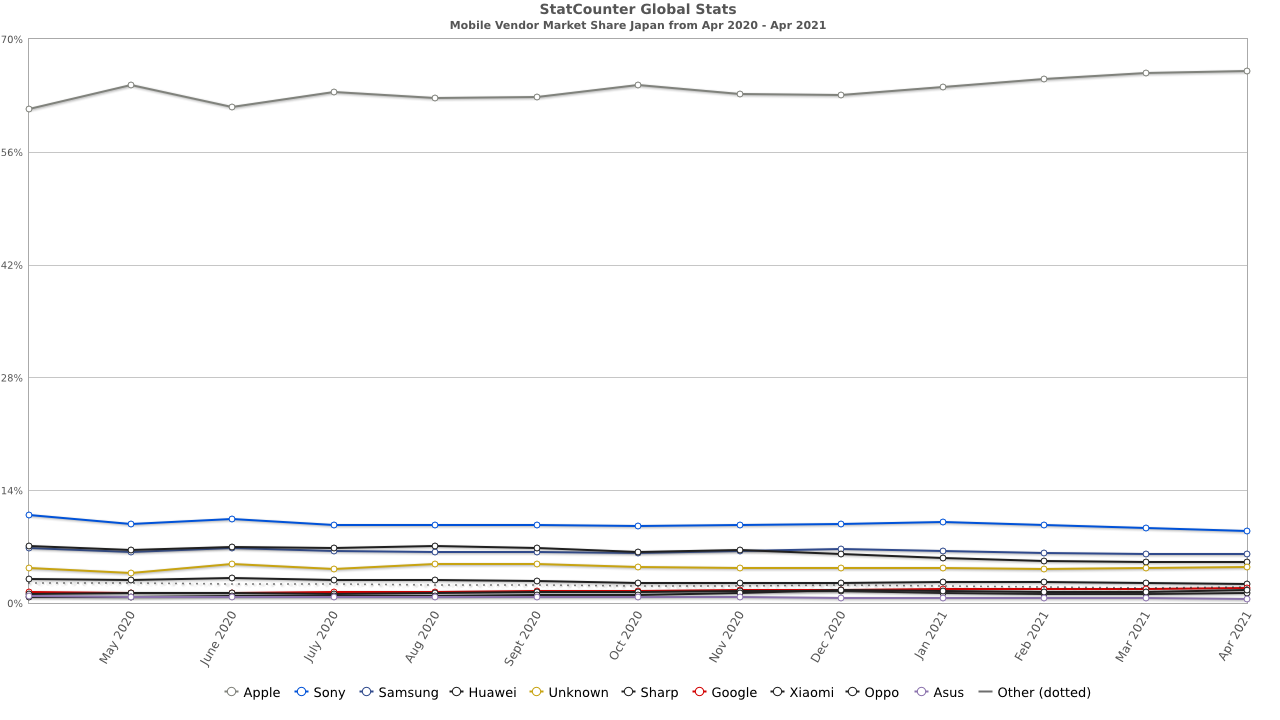

Mobile Market Share

Source: https://gs.statcounter.com/vendor-market-share/mobile/japan

On mobile market share, Apple remains the top brand used in Japan at 65.81%. Many Japanese users patronize iPhones as their preferred mobile devices. Sony follows this at 9.33%, and Samsung with 6.08% of mobile users in Japan.

Businesses can use this data to plan their user approach and strategies for their mobile marketing goals in Japan.

Overview of the Marketing Landscape in Japan

The Land of the Rising Sun might be one of the strongest e-commerce markets, but it has distinct marketing techniques that only work best in the country and might not work the same overseas.

For instance, many traditionally-managed Japanese companies still invest in old-school marketing strategies:

- Publishing magazine ads

- Having a mascot stand outside shops

- Giving out flyers on the streets

Additionally, Kanji symbols may have multiple meanings, and the Japanese writing system is complex. Japanese SEO content and marketing campaigns cannot entirely rely on machine translation, as local insight is crucial to adhere to cultural significance.

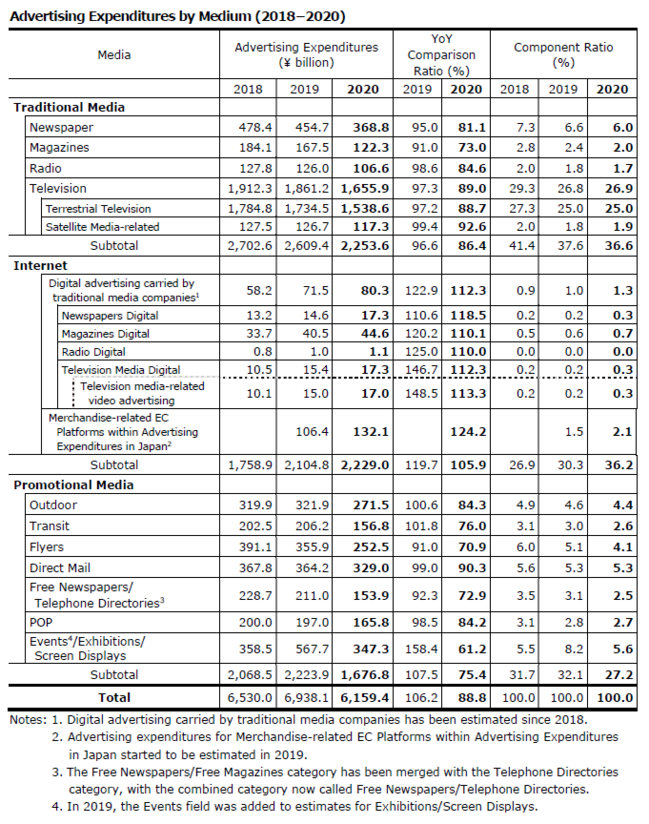

Regardless, digital marketing is now making waves in Japan. According to Dentsu, advertising expenditures in Japan amounted to 6,159.4 billion JPY in 2020, which is classified into three broad areas: (1) Traditional media advertising expenditures; (2) Internet advertising expenditures; and (3) Promotional media advertising expenditures.

Local businesses now tap into various online marketing and e-commerce strategies, especially after a series of successful performance-based campaigns by big brands. Successful campaigns in the country greatly depend on forming authentic connections and partnerships.

Some international companies may find it challenging to succeed in the Japanese market, but they can keep up with local competition through extensive market research and strategy development. Businesses should carefully plan their marketing strategies before investing effort, money, and time.

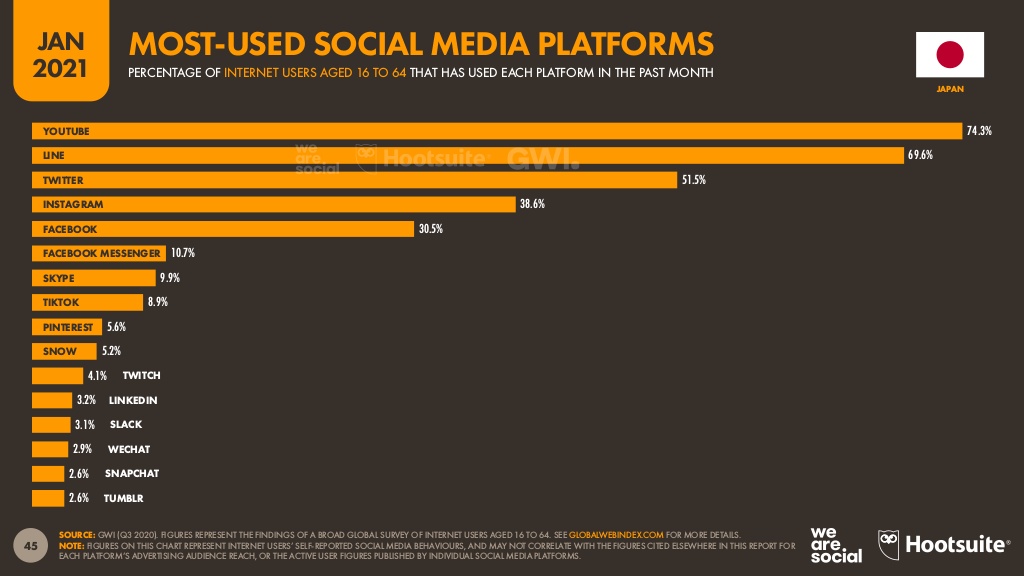

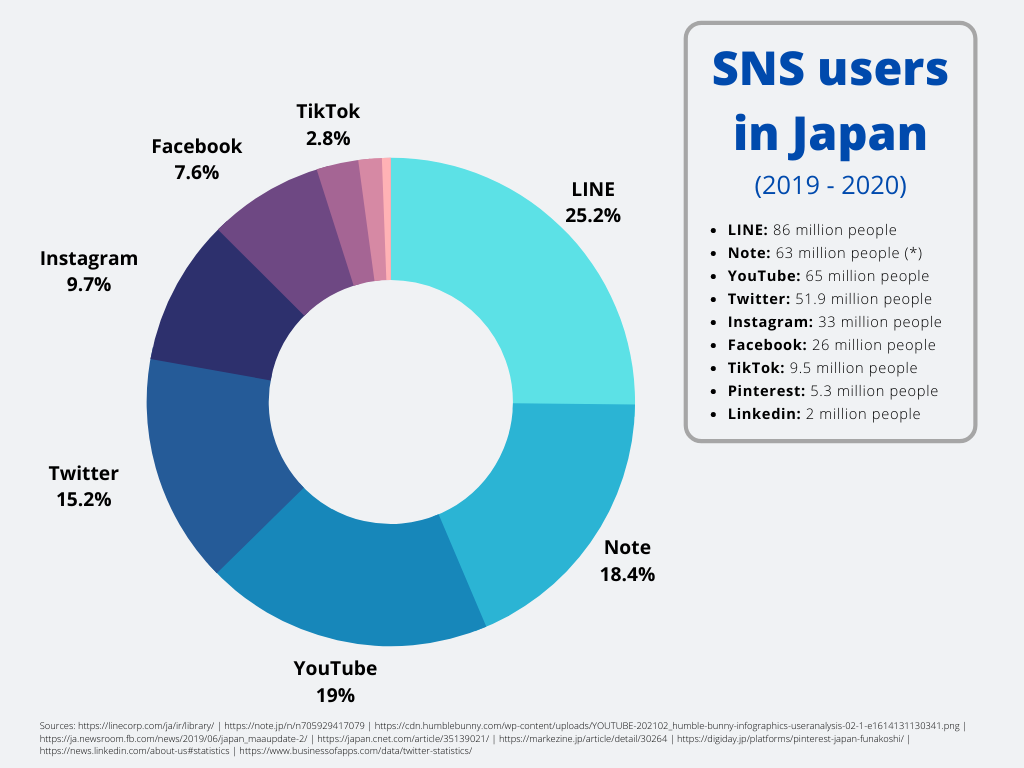

Biggest Social Media Platforms

Source: https://datareportal.com/reports/digital-2021-japan

Expanding your market in Japan using social media relies on most Japanese people’s majorly used social media platforms.

YouTube dominates the most popular social media site list at 74.3%, with the video-sharing platform serving as their source of information and entertainment. LINE follows at 69.6%, a popular app in Japan acting as a platform for communication, news, shopping, and more.

Twitter ranks third on the list at 51.5%, with Japanese users looking for updates and new information on the platform. Fourth is Instagram at 38.6%, where users look at photos, get creative inspiration, establish their online brand, and shop. Facebook is ranked fifth at 30.5% as a platform to get information, stay updated with their friends or loved ones, and instant messaging.

With this data, marketers will know which social media platform is effective for their marketing strategies in Japan and determine what’s best for your business growth.

Trends and Opportunities when Marketing in Japan

Japan’s booming economy and pushing forward to continuous innovation provide solid ground for businesses to grow. It is hard to deny that Japan’s footprint on the world’s economy and the country has become known for developing intelligent concepts and taking an innovative approach to business. Today it is considered a trendsetting market.

To win the trust and loyalty of Japanese consumers, you will need a more sophisticated approach toward delivering an exceptional customer experience for both in-store and online shoppers across multiple devices. A unified commerce strategy should be a top priority.

E-commerce

Source: https://datareportal.com/reports/digital-2021-japan

Japan’s e-commerce industry continues to grow amid the coronavirus pandemic, with 81.6% of users searching for products and services online. 85% of Japanese consumers visit an online retail site or store, while 48.4% use a shopping app either through a mobile device or tablet.

73.7% of Japanese users purchase a product online on any device. In particular, 32.1% use a mobile device to buy online.

More consumers are encouraged to make purchases due to the tremendous amount of content generated in real-time. Potential customers can search for any information they want to know, whenever and wherever they want. Hence, many are inclined to search and buy online instead of physically visiting a retail store.

Small and medium companies will continue joining the competition in the market. They will need constant innovation and specific targeting towards Japanese consumers, as their marketing and advertising strategies will help them reach a broader audience.

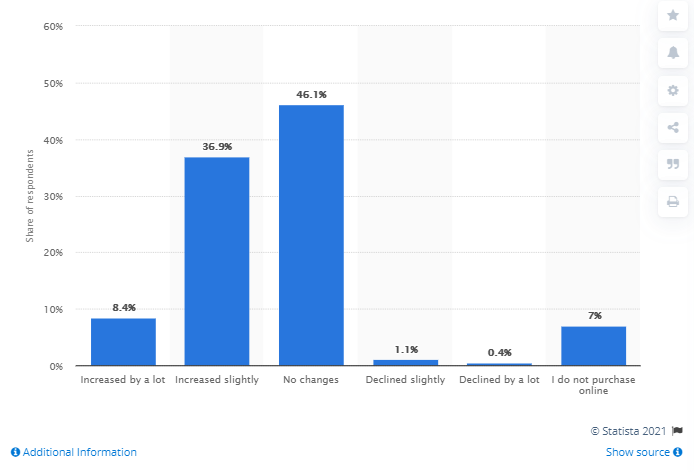

Recent Online Purchase Behavior

Ecommerce and online sales in Japan have evolved into a more significant role in the overall consumer experience, with more Japanese citizens spending most of their time at home due to current coronavirus restrictions.

According to a Statista Survey conducted in March 2021, around 46 percent of Japanese respondents reported an increase in online purchases during the coronavirus pandemic. Also, 8 percent affirmed that they frequently bought more items online than at the start of the pandemic in 2020.

The Japanese government asked citizens to encourage self-restraint and stay at home following the coronavirus pandemic; hence online retail became a popular alternative to in-store retail.

Advertising expenditures for merchandise-related e-commerce platforms amounted to 132.1 billion JPY in 2020 (up 24.2% from the previous year). With the rising numbers, businesses can look forward to online marketing in the following years.

Additionally, many traditional, brick-and-mortar businesses have considered e-commerce and digital marketing to help make up for lost in-store sales.

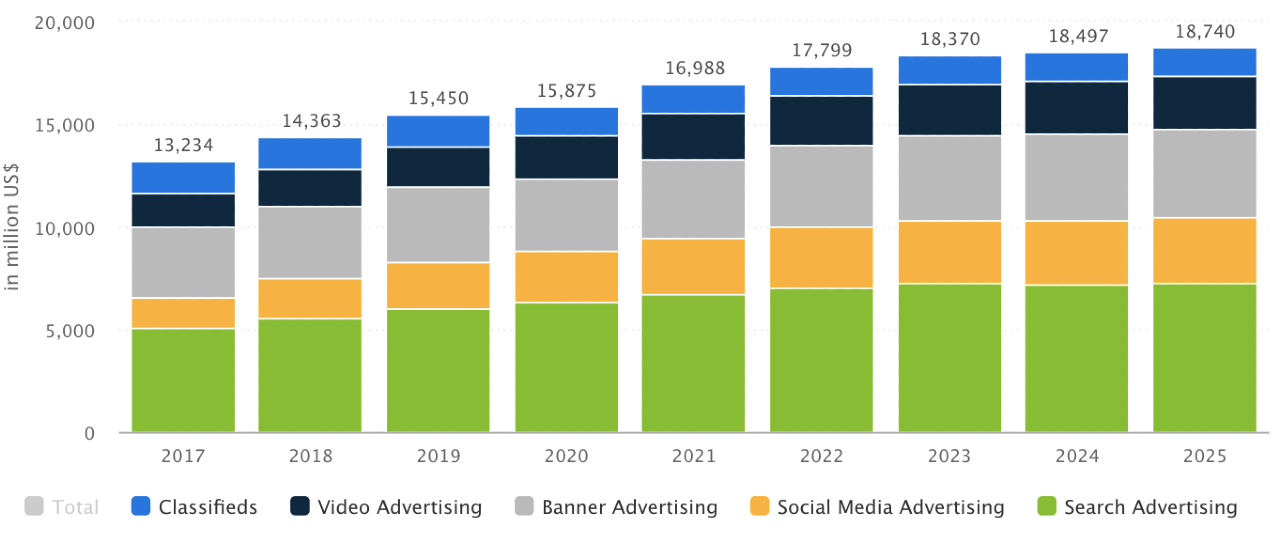

Digital Advertising Spend

Source: https://www.statista.com/outlook/dmo/digital-advertising/japan

Based on the data above, the yearly spending on digital advertising is projected to grow, with many businesses planning to market online in Japan.

The digital advertising market’s ad spending is expected to reach $17,266 million in 2021. Search Advertising is the market’s largest segment, with a projected market volume of $6,737 million in 2021.

Source: https://datareportal.com/reports/digital-2021-japan

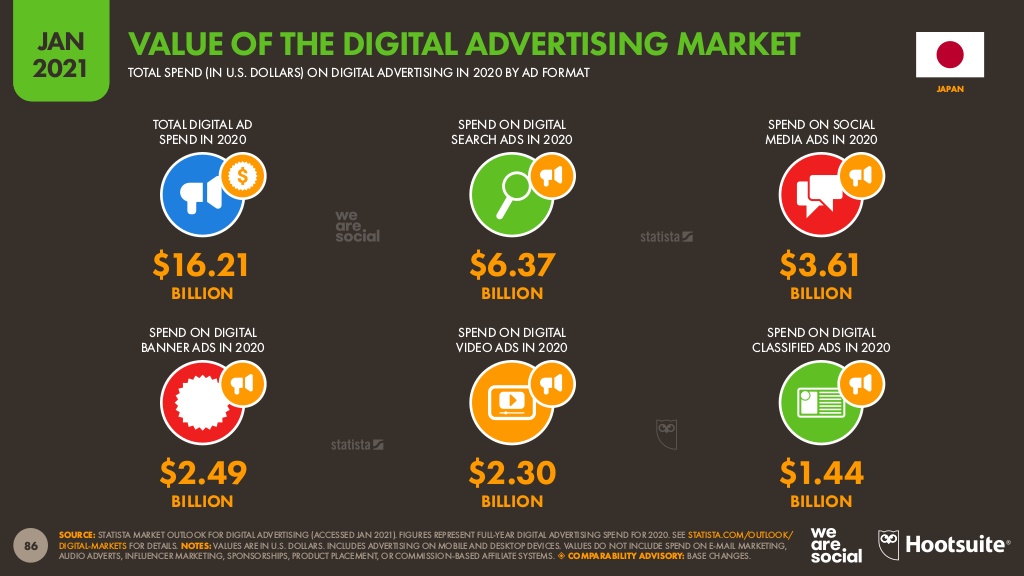

Japan might be slightly behind the rest of the world when it comes to digital marketing, but according to recent numbers, times have changed in the Land of the Rising Sun. The global switch to digital has emphasized significant digital marketing growth in the country.

Even traditional companies in the country began to convert to digital signatures. Hence some changes and trends are expected to continue in the following years.

In 2020, the total digital ad spend reached $16.21 billion in Japan. The Coronavirus pandemic has pushed many local companies to adopt digital transformation, increasing their digital advertising budgets in the process.

This trend is projected to continue, with $6.37 billion spent on digital search ads, $3.61 billion on social media ads, $2.49 billion spent on digital banner ads, and $2.30 billion on digital video ads.

As previously discussed, Japan is a dominantly native-speaking country. With most of its citizens speaking Japanese, website localization requires consideration for cultural and linguistic factors.

Localizing your ads into Japanese will help your business penetrate the Japanese market, as localized creatives consistently outperform their English equivalents in both conversion rate (CR) and click-through rate (CTR).

Source: https://www.dentsu.co.jp/en/news/release/2021/0225-010341.html

2020 was a year of evolution and growth for Japanese digital media advertising and sales campaigns. Besides the four mass media: magazines, newspapers, radio, and TV— digital media and online social platforms increase in popularity.

Content Marketing

Traditional marketing is evolving in Japan. With the rise of digital marketing and online media strategies, take a closer look at the average Japanese consumer’s characteristics to improve your marketing tactics in the country.

-

Localization

Businesses need to communicate effectively with potential Japanese customers or clients. With 121 million people speaking Japanese, the country’s dominant language, you need to integrate culture with your marketing techniques. It will help you create a unique yet effective strategy for your business.

-

Safe and secure

Most Japanese customers care about a product’s safety and security. Hence, many Japanese companies leverage their products and services with the following aspects. You will need to ensure your offerings are safe and secure if you want to successfully tap into Japanese consumer behavior.

-

Quality matters

Even a slight bruise or marking on your product would likely raise some complaints from Japanese customers. Japanese consumers care so much about details; hence it pays to ensure top-notch product quality for your products or services to become a hit in the country.

-

Fresh and new

A typical Japanese consumer likes new things that catch their attention. Many tend to jump right away upon discovering new things. For instance, if you consistently offer fresh food or new seasonal products— many local buyers will most likely turn into loyal customers.

-

Recommendations

Japan, which has retained traditional marketing and sales ways, pays importance to reputation and word-of-mouth recommendations. The majority of Japanese consumers rely on criteria like social and third-party evaluations for their purchasing decisions.

-

Beauty and aesthetics

Kawaii is a Japanese term that means “cute,” and cuteness is one unique yet highly-valued aesthetic quality in Japan. Many businesses prioritize having aesthetically pleasing and harmonious Japanese website content to attract consumers.

Therefore, exporting your content to an international audience is not just mere translation. To ensure your business’ effective content marketing in the country, you must consider cultural conventions, Japanese language (Kanji), formality, and current local trends, among others.

Omnichannel Marketing

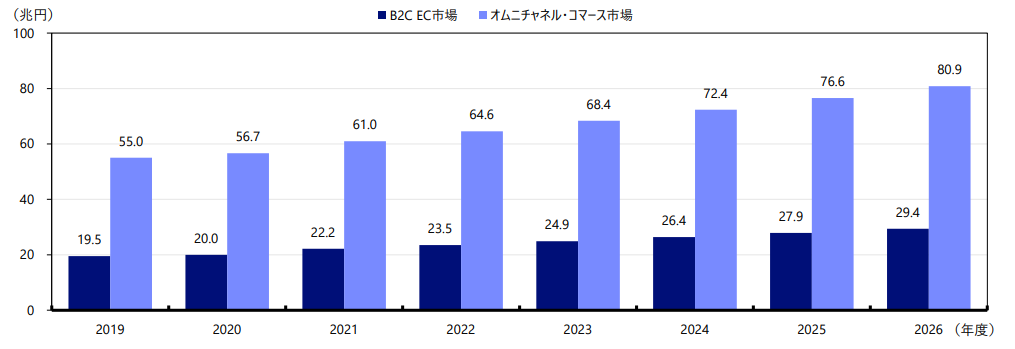

Source: https://www.nri.com/-/media/Corporate/jp/Files/PDF/knowledge/report/cc/mediaforum/2020/forum301.pdf

The 2021 market research report by Nomura Research Institute states that the market size of Business to Consumer (B to C) and E-commerce (EC) (consumer EC) will continue to grow in 2026 up to 29 trillion JPY. The omnichannel commerce market is projected to expand up to 80.9 trillion JPY.

Omnichannel marketing is essentially the need for marketers to provide a seamless experience, regardless of channel or device. Consumers need to engage with a company across all platforms, including their physical store and online presence.

Whenever a customer engages with a brand by clicking an ad or visiting a website, each of their social channels serves as a tool to relay the brand’s message effectively.

The smart money trend for 2021 is concentrating on content that it can share between several digital platforms. This joined-up approach to digital marketing strategy saves time and ensures a consistent message that can improve engagement, user experience, and the modern buyer’s journey.

JapanConsuming, an online publication devoted to the Japanese retail industry, predicts that 20% of all retail sales will happen online by 2023, thanks to a combination of widespread smartphone use and easy compare-and-contrast options. These are only a couple of features that digital marketing can offer Japan’s famously discerning consumers.

Search Engine Marketing (SEM) and Search Engine Optimization (SEO)

As previously mentioned, most Japanese internet users prefer Google as their primary search engine at 75%, followed by Yahoo! Japan at 62%. It might come off as a surprise, but Yahoo continues to thrive in Japan. Accordingly, businesses must pay attention to Yahoo alongside Google for their Search Engine Marketing (SEM) strategies.

The prominence of Google and Yahoo is prevalent in Japanese online culture. Paid advertising has a similar approach to what digital marketers are accustomed to, but the content must be in Japanese to increase the likelihood of new user clicks.

One significant difference in Japanese search engines is the use of Japanese characters, which is why localization is essential. Keep in mind that Japanese ads differ in details and information presented.

For your business to effectively tap the Japanese online market, prioritize having your campaigns and websites be translated and culturally customized for the local audience.

Effective promotion in the country also includes global search engine optimization (SEO) of your Japanese website content, promoting through popular search engines, Japanese keywords, and Japanese domain registration.

Video Marketing

Source: https://www.instagram.com/crocsjp

Japanese consumers love video, whether it runs for seconds, minutes, or hours. According to research, video marketing was the 3rd most popular weekly online smartphone activity in 2018.

With that in mind, expect a lot more brands in Japan to dive into the trend. Consumers will see more video content and total ad spending on various video social media platforms (YouTube, Instagram, TikTok) in the following years.

Mobile video ad revenue in Japan is forecasted to grow to $885 million in 2021, up from $199 million in 2015. It comes with a significant focus on video marketing.

Youtube, a video-based SNS platform, is the second most popular platform in Japan. Meanwhile, TikTok is among the fastest-growing platforms in the country. These platforms are becoming essential channels for marketing.

Manga Marketing

Source: https://grapee.jp/35911

As anime and manga (comics) became an integral part of Japanese popular culture, their influence is widely felt. Some marketers even incorporate manga marketing in their digital strategies, primarily to achieve a more substantial impact and capture the interest of young people.

Typical online ads do not effectively capture the attention of many. Most people rarely go out of their way to read them. However, with manga advertising, both visuals and words allow people to understand and retain more information easily.

Many also grew up reading manga as a staple form of entertainment— hence it’s likely for the typical Japanese consumer to read ads that incorporate manga.

Social Media Marketing in Japan

Source: https://www.facebook.com/business/success/mercedes-benz-japan

Many businesses realize the importance of advertising on social media, and thus social media marketing is gaining significance. It has become a core component of many companies’ overall digital strategy.

All over the world, consumers are increasingly spending more time on social media, so social networking services are becoming outlets where brands can communicate with consumers. Japan is no exception. Japanese consumers spend a lot of time on global social media platforms like Twitter, Facebook, and Instagram, and local varieties such as LINE.

Let’s take a closer look at how Mercedes Benz Japan drove traffic to its website. It generated leads using automotive inventory ads that show relevant inventory based on what customers indicated an interest in purchasing.

Influencer Marketing in Japan

According to Japanese market research firm Digital InFact, the value of the influencer marketing industry in Japan exceeded $200 million in 2018. It is projected to double in growth to over $500 million by 2023.

Continued growth is expected from both YouTube and Instagram, while various other SNS platforms (besides Twitter and blogging) are also predicted to see increased spending.

Just as in other marketing, key opinion leaders have risen in Japanese society. Influencers are starting to become celebrities in their own right. The more followers they have, the more they can demand to endorse different products and services.

YouTube is currently one of the most popular platforms for influencers in Japan, with the most popular influencers having their main channel. Meanwhile, TikTok and Instagram Stories are becoming popular for influencers to share snippets of themselves enjoying the latest restaurant or unboxing a new product.

For international businesses seeking to establish trust and credibility in Japan, obtaining the support of local influencers is a significant investment. Genuine expressions of interest in your product or service by popular influencers carry real value.

Affiliate Marketing

Affiliate marketing has proven its value in business ROI in Japan. Today, more brands are starting to consider the channel as a crucial part of their overall marketing strategy.

According to Statista, the market size of affiliate marketing in Japan is projected to reach $4.27 million by 2023. Some of the factors driving its future growth are the increased online ad spend of major advertisers and the influence of the e-commerce market.

Japanese companies have invested increasingly in affiliate marketing over the past few years. One reason for the upward trend of such performance-based marketing efforts lies in successful conversion, allowing consumers in Japan to easily access affiliate links via their portable devices, such as smartphones or tablets.

Marketing Success Stories

JTB Corporation Video

Japan’s inbound markets face rapidly increasing demands, including those of foreign exchange students wanting to visit Japan for “educational vacations.” With a specific target audience in mind, JTB Corp. wished to utilize video as a sales tool to increase awareness and the appeal of Japan as a premier destination.

The resulting video was more than just a sales tool. It also served as a product that effectively exemplifies both JTB’s brand slogan of “Perfect moments, always” and their campaign message ahead of the 2020 Tokyo Olympic and Paralympic Games, “Bridging the New: Connections Lead to Beginnings.”

The team behind the campaign was diverse, spearheaded by an American director, camerapersons from the UK and Hong Kong, and a Japanese producer. It highlights the importance of focusing on the strengths in a global market to deliver a message to overseas consumers through video.

Thermo Fisher Scientific SEM

Localizing your ads will significantly improve the performance of your Pay Per Click (PPC) ads in Japan, which is observed in Thermo Fisher Scientific’s PPC account after its localized onboarding since June 2011. Tapping the help of a Japanese marketing agency offers a deeper understanding of Japanese business marketing and search engine marketing.

There has been a strong and steady positive outcome during the first year thanks to the superb communication, highly flexible approach, and impressive skills at keyword optimization.

Thermo Fisher Scientific’s keyword impression rate in Japan increased significantly in just one year. Since page rankings have shown an overall improvement in Google search queries, conversions also continued to grow. A local agency helps international businesses optimize keywords in English and the three different writing systems in Japanese.

Pocky and Kirin Milk Tea – Those Adolescent Days

Source: https://www.kirin.co.jp/products/softdrink/gogo/pocky-gogotea-jp

In 2019, Glico and Kirin teamed up in a joint limited-time packaging campaign for their most popular products to mark the end of the Heisei era.

Glico’s Pocky special tie-up collaboration with Kirin’s Gogo no Kocha (afternoon tea) brand of milk tea drinks created a nostalgic drink and snack combination, based around the theme of “Those Adolescent Days.”

The collectible package designs depict gorgeous scenes featuring Japanese high school students over three decades of the Heisei era. When combined with the Pocky packs, the designs create different classroom scenes, heightening the sense of nostalgia for customers who lived their student lives during the different periods.

The pair/matching packaging had to be bought together to create a charming scene through playful package design. This collaboration became very popular, and many young consumers shared their take on social media.

P&G – Fabreze W Deodorant Entrance Deodorant

Source: https://www.youtube.com/watch?v=r2HiFREuIpk

P&G Febreze first entered Japan in 1973 and has since seen its success in Japan due to its robust marketing strategies. Today, it’s one of the most recognizable products for odor elimination among Japanese consumers.

Their marketing team researches the endeavor details of Japanese consumers. For one, they found out that Japanese consumers are susceptible to smells and odors, especially hard-to-wash items and areas in the house such as the entrance where there’s “living odor.”

To cater to this specific need, the “Febreze W Deodorant for Entrance” was developed. The product design incorporates fluid dynamics with a 360 ° deodorant technology that effectively spreads the active ingredient throughout the limited, narrow space.

Febreze’s TV commercials for this product primarily feature visual guides to explain the technology and homemakers— who are expected to significantly benefit from the product to make their household a bit more tidy and pleasant.

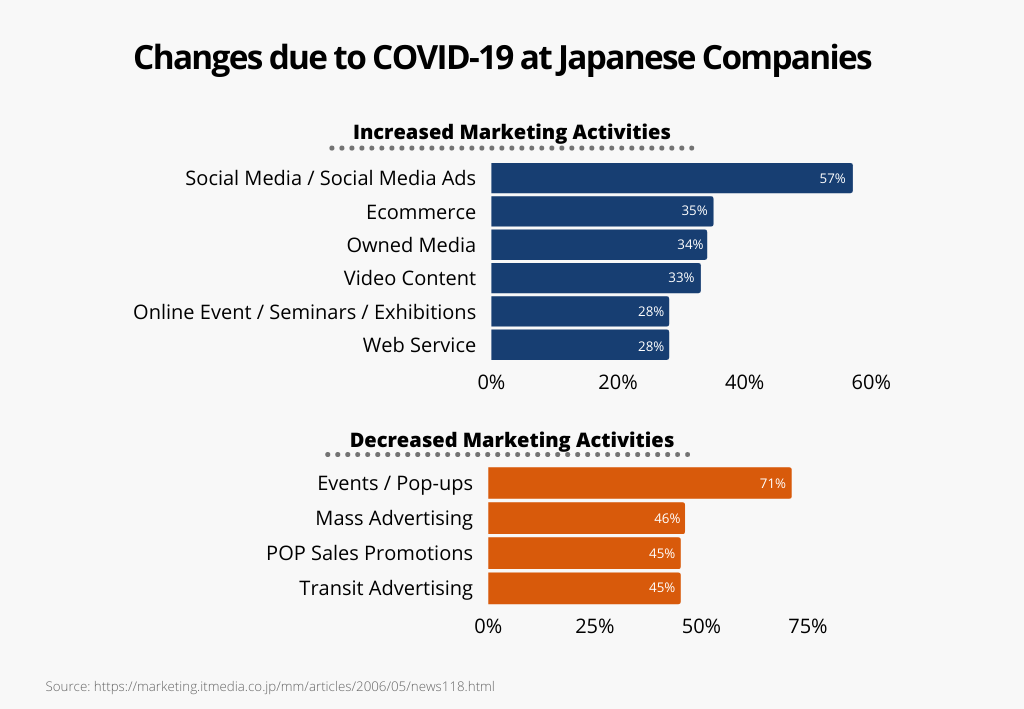

The Impact of COVID-19 on Marketing Activities in Japan

Marketing IT Media investigated approximately 160 Japanese companies to know the impact of the COVID-19 pandemic on their marketing activities.

Many companies are affected in terms of advertising and sales activities such as event or pop-up stores (71%), mass advertising (46%), in-store promotion and analysis (45%), and traffic advertising (45%). However, some companies increased their marketing activities and digital-related initiatives such as SNS advertising (57%), e-commerce (35%), owned media (34%), video utilization (33%), online events/seminars/exhibitions (28%), and web customer service (28%).

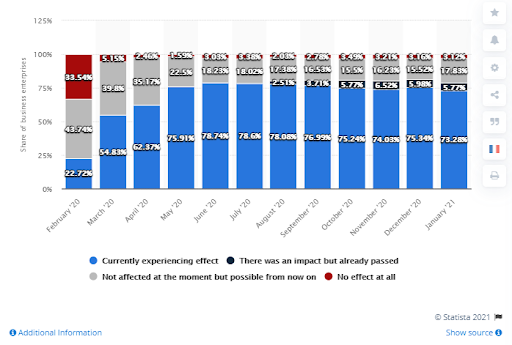

Accordingly, a Statista survey in January 2021 found out that 73 percent of businesses in Japan experienced an impact of the coronavirus pandemic on their corporate activities.

Adding the share of companies that foresaw a possible effect on their business soon, around 91 percent of the companies considered that they were somewhat affected by a coronavirus. Only close to six percent stated that they no longer experience the impact of the outbreak.

Tokyo 2020 Summer Olympics

In 2020, Japan was filled with pride and excitement in preparation for the upcoming Tokyo Olympics. The Olympic Games were expected to bring in as much as 32 trillion JPY or 300 billion USD in revenue.

However, the whole production of the Summer Games was put on hold, as the world suffered an economic crippling global pandemic. Local Japanese companies were looking to capitalize on the Olympic craze by promoting their products and services and building brand awareness through social media.

The rare opportunity to showcase and advertise your business on not just a national scale but a worldwide one would have meant a surefire increase in online traffic and sales.

Not all hope is lost, however. Advertisers now have a new opportunity to seize the millennial population. With more people relying on the internet, particularly on social media for entertainment, none have provided more amusement than online influencers.

Businesses can now advertise products and services through Japanese influencers. Influencers can either take to Twitter, Facebook, Instagram, LINE, or Youtube to effectively reach Japanese millennials, as these platforms are considered to be the most popular among the generation.

Are You Prepared for Successful Marketing in Japan?

Today, we are already witnessing a more competitive market for digital advertising in Japan than in previous years. Total digital advertising and online media expenditures are expected to rise, especially Japanese PPC and SEO, social media marketing, and video advertising strategies.

With that in mind, international businesses looking to enter Japan’s highly competitive market should plan appropriate marketing strategies and effectively target consumers to find success.

A digital marketing agency experienced in the Japanese market, language, and localization can help you achieve your marketing goals in the Land of the Rising Sun. Contact us at Info Cubic Japan today to learn more about our services.