Japan is currently one of the world’s fastest growing e-commerce markets. Some of the factors attributed to the rapid growth of e-commerce in Japan include the single language culture, developed economy, and highly urbanized population.

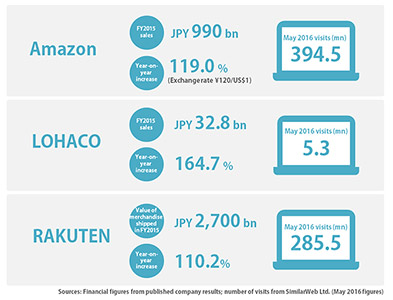

There are three major players in the Japanese e-commerce market: Amazon, Rakuten and Yahoo! Shopping (Lohaco). Meanwhile, a continued rise of m-commerce, transactions completed via mobile device apps, brings more options and expands on the C2C environment. Coupled with a developed distribution infrastructure and small country size for convenient and expedient delivery, this ensures Japan’s rate of e-commerce growth will only continue.

From 2018 to 2022, it is expected that the annual growth rate for revenue will be 6.2% and that Japan will remain one of the top 5 largest e-commerce markets in the world.

Japanese E-Commerce Market

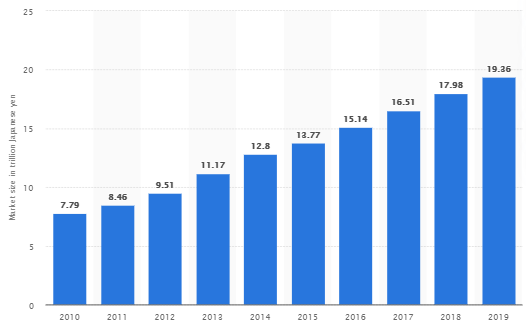

Among the e-commerce markets in the world, Japan ranks as the third largest and one of the fastest growing. A research on Business-to-consumer (B2C) e-commerce market size in Japan from 2010 to 2019 indicates that the total value of the B2C e-commerce market in the country amounted to around 19.4 trillion Japanese yen in 2019. This was an increase from only below 18 trillion yen in the previous year.

During the last decade, the market size grew steadily as it is boosted by the interest in smooth processing services and efficient distribution channels.

Image source: https://www.statista.com/statistics/901251/japan-b2c-e-commerce-market-size/

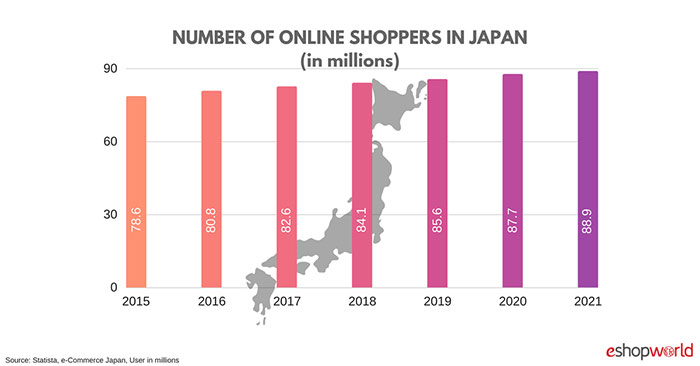

The estimated number of e-commerce users in Japan is forecasted to increase to 6.33 million users in 2021. By that time, it has been projected that users will spend an average of $1,257.37 online.

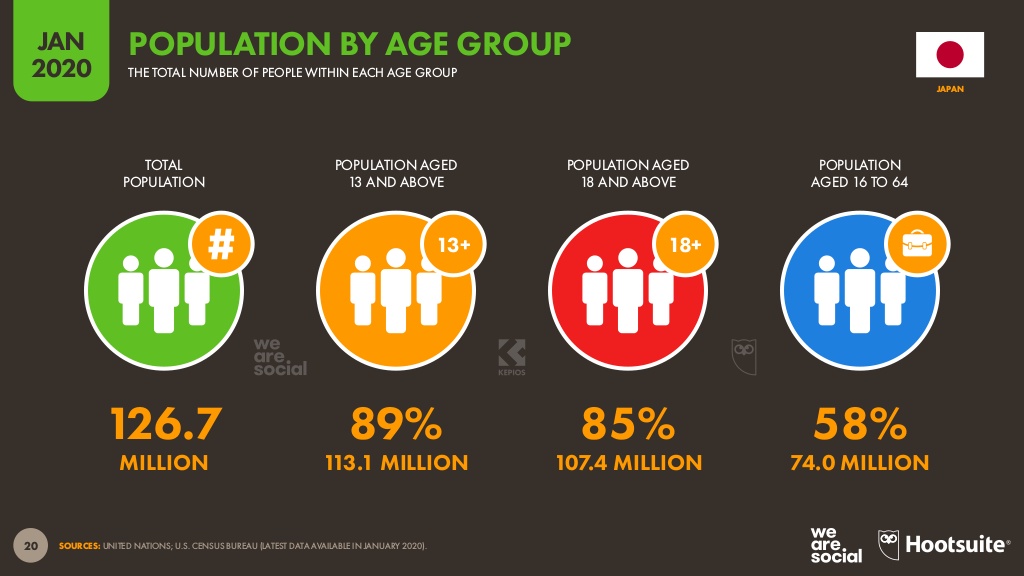

Japan indicates a significant market opportunity for e-commerce businesses due to Internet penetration estimated at 92% of the population. To provide a clearer picture of Japanese e-commerce markets, internet usage can be divided into different age groups: 89% of 13 year-olds and above, 85% of 18 year-olds and above and 58% of the population aged 16-64 log on daily.

Image source: https://datareportal.com/reports/digital-2020-japan

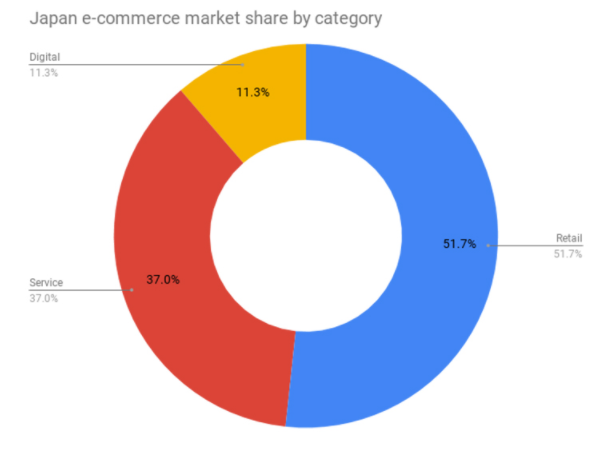

Further research done by the Ministry of Economy, Trade, and Industry (METI) in order to determine the breakdown of total expenditure divided e-commerce expenses into three categories: sales of retail goods, service, and digital.

It was found that sales of retail goods account for 51.7% of the total e-commerce expenditure in 2019, with a growth rate of 8.12% from the year prior. On the other hand, service accounts for 37% of the total e-commerce expenditure with a 11.59% growth rate. Lastly, digital sales account for 11.3% of the total e-commerce expenditure, with a 4.64% growth rate.

The most popular trend was electronic publishing (e-books and e-magazines) followed by paid music distribution and online games. The increasing popularity of smartphones is believed to have greatly contributed to the growth of these trends.

Image source: https://www.meti.go.jp/press/2019/05/20190516002/20190516002-1.pdf

Among different payment methods, 66.1% of Japanese shoppers have a preference for using credit cards online, compared to 26.9% who like to pay with cash on delivery.

The digital landscape of Japan is currently experiencing internet penetration at 92%. Competition in the current e-commerce environment has led to a great amount of spending on marketing. According to a JETRO survey, 24.4% of the domestic Japanese companies involved in the survey reported that they sell via e-commerce and roughly half of them are selling to consumers in the overseas market.

Platforms for E-Commerce in Japan

There are four different categories of e-commerce platforms in Japan where businesses can sell their products online: e-commerce marketplaces, apparel-specific marketplaces, free market apps, and handmade product platforms.

E-commerce Marketplaces

Under this category falls the most popular e-commerce platforms such as Amazon Japan, Rakuten and Lohaco (Yahoo! Shopping Japan) which accounts for almost 50% of e-commerce sales in Japan. Historically, Rakuten has been the clear leader, but in recent years Amazon Japan has increased its presence in the market by investing in its own network of distribution centers. It was announced last year that the Amazon Japan website will accept UnionPay cards to attract more customers from the overseas Chinese market. Rakuten remains competitive but Yahoo! Shopping Japan has lost market share allowing Amazon Japan to continue its steady growth.

Apparel–specific Marketplaces

Japan has several unique platforms dedicated to selling apparel products and sometimes jewelry. Within the apparel industry, the share for e-commerce sales totals to 14% in 2019 and this number has been steadily rising. Among the top online marketplaces for apparel are Zozotown and Uniqlo. Zozotown holds the top spot for apparel online stores in Japan with a market capitalization amounting to $9.1 billion.

Free Market Apps

In 2018, METI reports emphasized the rapid growth of net auction sites where free market applications’ worth amounted to 639.2 billion yen, an increase of 32.2% from 2017. This drastic climb is likely to continue, making free market apps one of Japan’s most lucrative markets. One of the top free market e-commerce platforms is Mercari, dubbed as Japan’s startup unicorn, which had a forecasted total market cap of 365.4 billion JPY in 2018.

Handmade Product Platforms

There are about 40 major platforms in the handmade marketplace in Japan. This market doubled in 2014 from 3.5 billion to 7.8 billion yen, which indicates a significant potential for further growth.

One of the leading e-commerce platforms for handmade products is Creema. Since its foundation in 2010, Creema now houses over 60,000 registered creators, listing over 2.4 million handmade items. The online handmade market has achieved incredible development in Japan, indicating consumers’ interest in affordable but unique and high-quality products.

How to Succeed at E-commerce in Japan

The growth of e-commerce in Japan has indeed introduced many opportunities for businesses. Thus, digital marketing in Japan is incredibly important to a product’s success as most Japanese have internet access and smartphones. In recent times, digital marketing has become one of the major ways in which businesses reach out to consumers. Here are several tips in digital marketing that may pave the way for e-commerce success.

In-depth localization

More than 99% of Japan’s population speak only Japanese; thus, it is necessary for companies to have in-depth translation and localization in their e-commerce business. It is essential for Japanese consumers to be informed of details about technical specifications, fabrics and measurements in order for them to trust the seller.

Localization is more than just merely translation. There are also certain cultural specificities that need to be considered. Implementing a proper localization strategy can make customers feel familiar and comfortable, warming them up to a brand more quickly. A brand’s failure to localize and establish itself properly in Japan will elicit a lack of trust and reliability from potential customers.

Differences between western and Japanese e-commerce can be immediately noticed. Japanese marketplaces are observed to be busier and more complex compared to their western counterparts and are heavy on content, with HD photos, professional models and staged settings. Thus, the minimal design and wide-open space that western sellers are used to may not appeal to Japanese online shoppers. A product’s presentation is vital to Japanese buyers. Images of the product are expected to display all the details of the item so the customers can clearly see what they are paying for.

Be aggressive with search

Image credit: Twin Design / Shutterstock.com

Search engine optimization is the process of making web pages easy for those searching through the web to access and index. In other words, if Google, Bing, and other search engines can easily find and catalog the content of a site’s page, it can more easily list that site on the appropriate results pages.

For an e-commerce business, the search program (SEM or SEO) is considered as one of the most important marketing channels. SEO goes together with any organic content marketing strategy, as it helps ensure that content is surfaced as much as possible. If done well, SEO can help make a brand’s website easy to find, which can lead to success in marketing.

Targeting: Hit the Bullseye

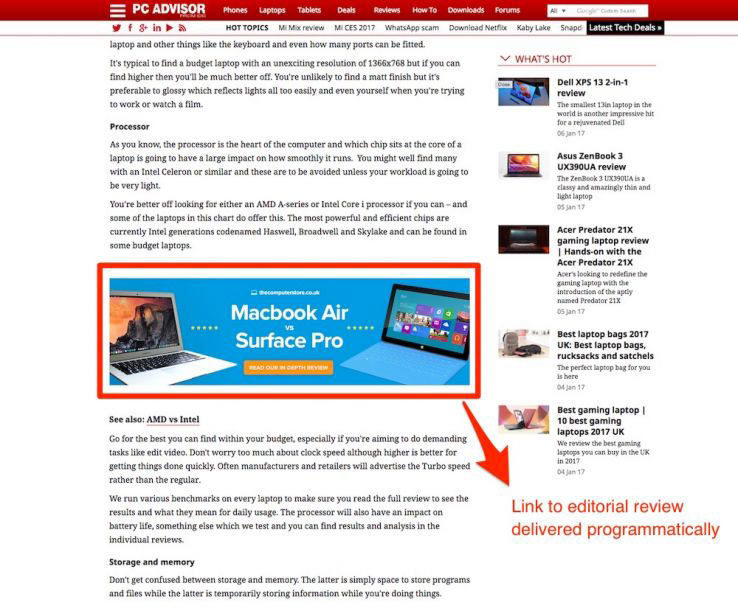

Japan’s targeted advertising has evolved over the past few years. One of the ways to achieve effective and efficient targeting is through programmatic advertising. Programmatic ad buying involves using software and algorithms to purchase digital display space and is a way for businesses to reach their target audience. This method uses audience data and insights from different sources to show highly relevant ads at the right time, in the right place, to the right people.

The capability for e-commerce players to target specific audiences down to age, gender, interest, and behavior across various networks has immensely helped them increase their return on investment and gain substantial data learning simultaneously.

Go mobile

Image source: https://asia.nikkei.com/Business/Companies/Mercari-builds-buzz-beyond-flea-market-apps

In recent years, the amount of e-commerce shoppers in Japan that make purchases using their mobile devices has been increasing. This trend has caused big retailers like Uniqlo to participate in online malls such as ZOZOTOWN. These online malls allow B2C commerce to occur at a higher convenience for the consumer which will continue to drive sales with the expected increase of mobile penetration rate to reach 54.4% within the next 4 years.

The mobile commerce growth of the last several years has also given rise to an increase in C2C buying and selling habits thanks in part to apps like Mercari. Since its inception in 2013, the Mercari app has seen more than 100 million downloads not only in Japan but also in other countries such as the US and the UK. Mercari has also taken steps to increase protection against fraud for their users by requiring a seller to input more personal information before listing an item on the marketplace.

At present, 45% of Japan’s internet users aged 16-64 years old shops with their mobile phones, comprising a great portion of the total e-commerce sales in the country made through mobile devices. Therefore, it is essential for businesses to have a mobile-optimized site or mobile app in order to have e-commerce success.

Deliver Great Content

Image source: https://neilpatel.com/blog/ecommerce-content-marketing-for-shopify/

E-commerce sites have a tendency to focus solely on the booking process and overlook the piece on experience. In Japan, there have been several great examples recently of sites developing quality content that incorporates text articles, videos, and social integration elements that provide a better user experience, which then improves and eases the buying process. What’s more, if the content is optimized well for SEO, they can also act as major traffic drivers for a business.

One of the advantages of delivering great content is it enables a company to build a reputation. The present digital marketplace is very busy; thus, it is essential for businesses to gain the trust of their customers. Gaining the customer’s trust can help a company establish a positive brand reputation.

Through great content, companies can build trust with their consumers since they will be able to develop an opinion on the brand. If the content that they discover is educational, engaging, and valuable, they will relate these qualities to the brand it represents. The more value that a brand can provide with its content, the easier it will be for them to build trust with their target audience.

Can You Manage E-Commerce in Japan Successfully?

In summary, there has been an explosion in Japan’s e-commerce market due to the prevalence of internet and mobile use, developed economy and high urbanization. Thus, this market has introduced a lot of opportunities for those seeking to start a business in the country. There are several platforms that are involved in e-commerce including e-commerce marketplaces such as Rakuten and Amazon Japan; apparel-specific marketplaces such as Zozotown and Uniqlo; free market apps such as Mercari; and handmade product platforms such as Creema.

In order to tap into the opportunities presented by the booming e-commerce market, this article supplies several tips and strategies. One of these strategies is for business to implement in-depth localization, which goes beyond mere translation. In addition, brands should also develop their SEO in order to become easily discoverable by potential customers. Companies can also utilize programmatic advertising in order to reach their target audience in the right place and at the right time. Another strategy is to optimize company websites and apps for mobile, since a huge percentage of Japan’s population use smartphones daily. Lastly, engage better with customers by providing great content.

These strategies are but a few that you can implement to achieve success in building an e-commerce business. Contact us today to learn more about e-commerce in Japan and take your e-commerce marketing to the next level.

Featured Photo by Jelleke Vanooteghem on Unsplash