With an overall economic freedom score of 89.1, Hong Kong remains one of the freest economies in the world, placing 2nd in 2020 behind Singapore. The US-based Heritage Foundation explains that countries with high economic freedom have business-friendly tax codes and governments that encourage innovation and entrepreneurship. The liberty granted in the business sector of Hong Kong creates more opportunities for companies to develop in the country. Additionally, foreign brands have a high chance of penetrating the local market.

Heritage Foundation studies also show that people of top-ranking countries live longer, have better health, are more educated, and have better ecological protectors. Considering these attributes for Hong Kongese consumers would indicate which businesses have the potential to flourish in this market. To set up shop in Hong Kong, marketers would have to identify what these economically free people need.

Hong Kongese Consumers

There are 7.47 million consumers in Hong Kong. Of this total population by mid-2020, 11.5% are Millennials or belong to the 20-29 age group, while 26.2% are Silver consumers aged 60 and older. Nielsen research suggests that marketing opportunities in Hong Kong lie in these two groups as they appear to be the most active among local consumers. To properly market to these specific demographics, brands would need to identify which products and services are most popular among their members. Here is a look into some Hong Kongese consumer habits to help determine where their priorities lie:

Dining out

According to Nielsen, before 2020’s global pandemic, Hong Kongese ate outside of their homes at least 3.70 times per week. This figure is the highest in the world and 2.6 times higher than the Asian average. Hong Kongese are also health-conscious when it comes to their food consumption. 8 out of 10 consumers between the ages of 50 and 64 cite health and fitness as key priorities in their lifestyle. These consumers purchase more organic breakfast cereal products, sugar-free juices, and nutritional supplements. This behavior suggests that food businesses, especially those that promote healthy diets, could potentially have opportunities to flourish in Hong Kong.

Video streaming

We Are Social and Hootsuite reported that Hong Kong consumers spend more than 40 hours of weekly Internet usage. At least 27% of internet users watch video-on-demand (VOD) programming. The South China Morning Post previously reported that US-based Netflix, mainland China’s LeEco, TVB’s MY Super TV, and PCCW’s ViuTV are among the major VOD providers in Hong Kong as of 2017. Upon consideration of these statistics, brands could potentially reach 27% of the Hong Kongese consumer market through product placement on video streaming platforms.

E-commerce

We Are Social and Hootsuite data states that 7 out of 10 Hong Kong consumers shop online. It is especially apparent among Millennials between the ages of 20 and 29. Due to the COVID-19 pandemic, e-commerce spending rose by 13.4% in 2020. Relatedly, around 36% of Hong Kongese had practiced purchasing groceries online to avoid huge crowds and observe social distancing. This statistic may be owed to the fact that Hong Kongese consumers prefer global brands; a study has shown that only 7% of locals are inclined to purchase homegrown brands.

Additionally, credit cards are widely accessible to Hong Kong consumers. According to the official press release of the Hong Kong Monetary authority, 19.52 million credit cards were in circulation by the end of the second quarter of 2020, with a total number of 203.71 million transactions. As the number of credit cards reaches over 250% of the total population of Hong Kong, it is apparent that the country has an active consumer market.

Marketing in Hong Kong

As previously mentioned, Hong Kong consumers favor global brands. The global advertising agency network McCann Worldgroup conducted a study in 2018 entitled “Truth about Global Brands 2: Decoding the Shifting Dynamics for Brands in Hong Kong and Southern China.” Survey results have shown that 64% of people in China trusted local brands instead of global brands. Meanwhile, only 7% of Hong Kong consumers trust local brands, indicating their preference for foreign brands.

The study has shown that consumers prefer foreign brands as they offer more options and have better quality. Hong Kongese are particularly interested in products that are on par with Japanese and Korean standard qualities. Thus, based on initial perception, global brands already have an edge in marketing to Hong Kong consumers.

Successful Brands

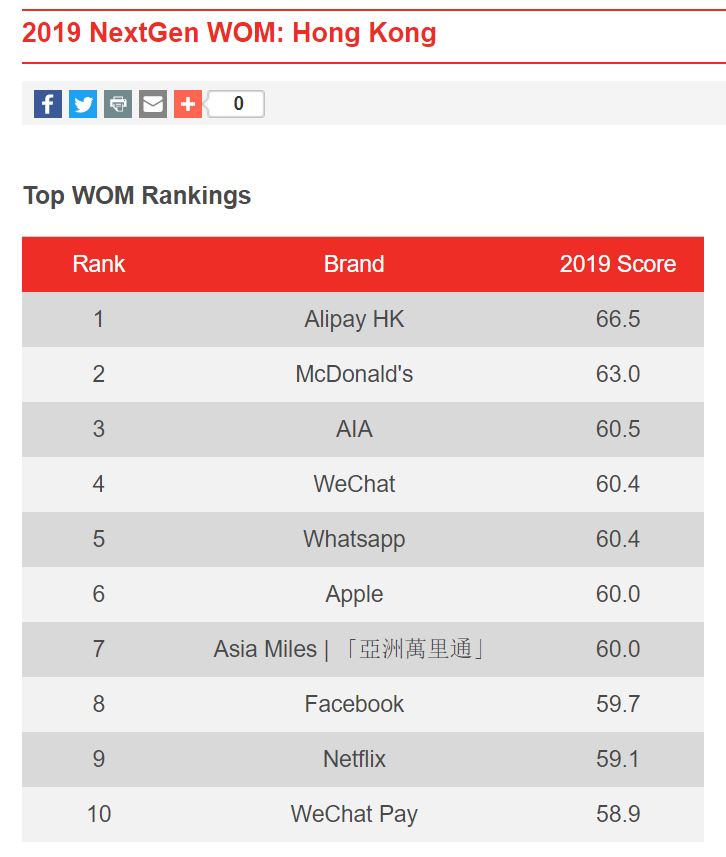

YouGov BrandIndex regularly ranks brands based on positive feedback. According to its methodology, YouGov screens 319 brands by asking respondents if they have heard positive news, advertising, or word of mouth (WOM) about these brands. These brands would then receive WOM scores when respondents mention which brands they have talked about with their family or friends within two weeks.

The latest data for brands in Hong Kong that have received the highest WOM scores contains statistics collected from young adults between the ages of 18-34, from September 1, 2018 to August 31, 2019. Although classified differently, a couple of these brands are related to finances, such as the payment services Alipay HK and WeChat Pay, which rank 1st and 10th, respectively. Another is the life insurance company AIA which ranked 3rd.

SNS brands such as WeChat, Whatsapp, and Facebook also scored among the top WOM rankings at 4th, 5th, and 8th, respectively. Other brands with high ranks include McDonald’s (2nd), Apple (6th), Asia Miles (7th), and Netflix (9th).

Source: https://www.brandindex.com/ranking/hong-kong/2019-wom

These statistics measure the success of brands in terms of how they have entered the daily lives and conversations of Hong Kongese consumers. The success of SNS brands such as Facebook and Whatsapp is inevitable in this digital age. Majority of the population rely on such services to stay connected with each other, as well as to remain updated on current events.

The classifications of other top WOM brands include food, insurance, technology, travel, and media services. Brands in similar fields may find success in the Hong Kong consumer market. However, it remains a challenge to compete with established presences. Brands would then have to advertise themselves through channels that are familiar and accessible to most of the population.

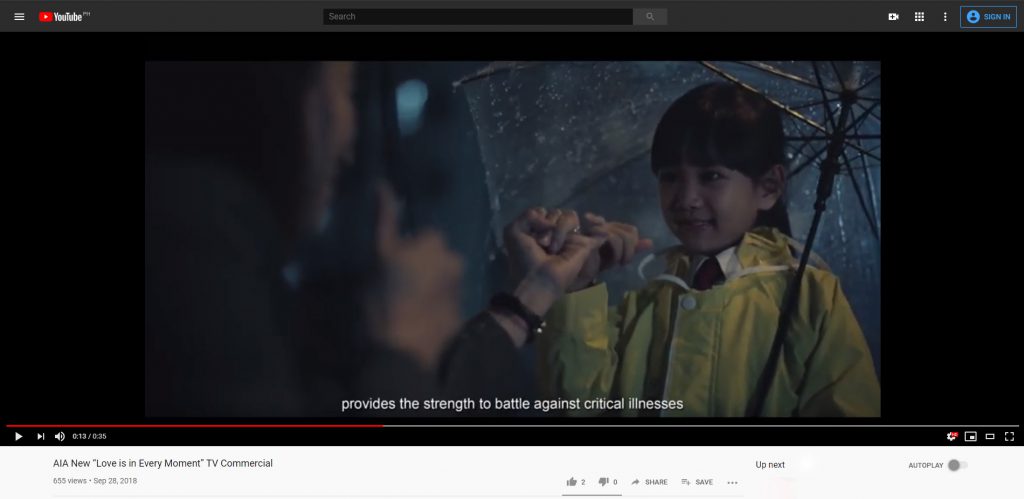

Among the top 10 WOM brands, AIA has recently won five gold and one silver awards for its excellence in marketing strategies. The Hong Kong subsidiary of AIA Group Limited is the first insurance company to be honored with the “Marketer of the Year” title at the Marketing Magazine’s prestigious “Marketing Excellence Awards 2018.”

Source: https://www.youtube.com/watch?v=f0DQ_koqlf0

Two of the gold awards AIA won were for “Excellence in Financial Advertising” and “Excellence in Media Strategy.” The brand was recognized for their “Love is in Every Moment” mini-film – Mother and Daughter Campaign. The ad campaign featured award-winning actress Anita Yuen and aimed to promote the brand’s “Protect Elite Ultra” life insurance for critical illness protection. AIA also utilized buses, newspapers, and television among other advertising platforms to spread the core messages surrounding their campaign.

Digital Marketing in Hong Kong

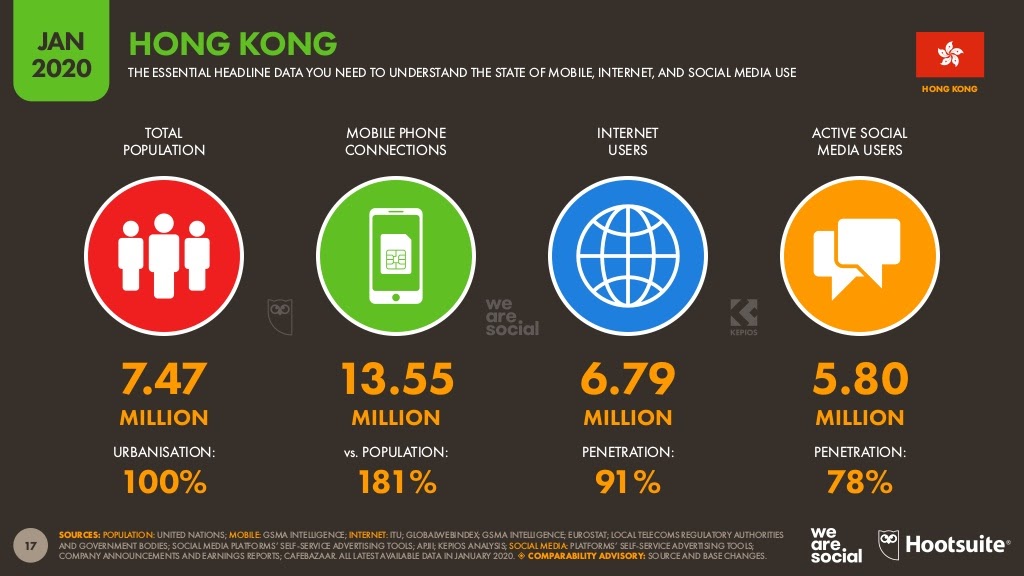

Source: https://datareportal.com/reports/digital-2020-hong-kong

Foreign businesses already have the upper hand in penetrating the Hong Kong consumer market based on statistical consumer preferences. Embracing e-commerce in digital marketing strategies is only appropriate. Out of the total population of Hong Kong, 91% have Internet access, and 78% are active on SNS channels. Brands would perform better through online networks, where Hong Kongese consumers spend a lot of their time. Also, brands would be more accessible with a solid online presence, whether through official websites or regular advertisements in SNS.

Hong Kongese consumers are also widely fluent in English, further reinforcing their openness to global products. Although English is an official language, Cantonese and Mandarin remain vital in verbal and written communication among Hong Kong consumers, especially in their daily work life. Having multilingual optimization for brand websites would appeal to 100% of Hong Kong consumers, and in turn, may boost WOM scores to secure the success of any brand.

Summary

Earning the trust of Hong Kongese consumers lies in recognizing their priorities. It goes to show that many opportunities lie in food and health brands, as the most active consumers of Hong Kong list these sectors among their top priorities. Foreign marketers in these lines of business also already have an advantage in penetrating the Hong Kong market since local consumers are inclined to patronize global brands. Presumably, these brands have already won over the hearts of Hong Kongese consumers even before setting up shop in the country.

Although relying on foreign status as an upper hand in establishing a brand in Hong Kong, it is also important to note that Hong Kongese consumers trust foreign brands, particularly because of the higher quality they offer. Brands must be able to assure Hong Kong consumers that they are getting the best quality with their products. Brands must also consider the 91% of the Hong Kong population connected to the Internet and the 27% who spend their time streaming videos on demand. As such, product placement and endorsements from Asian and Western celebrities may help reach target audiences.

As Hong Kong welcomes foreign investors in conducting business in the country, global brands could easily enter the local market. Businesses still have to ensure that they offer excellent products and services for consumers to fully trust their brand. Although challenging, brand success would depend on how well they meet the demands of the Hong Kong consumer market, particularly the active Millennial and Silver population groups. Contact us at Info Cubic Japan for more insight into winning the hearts of these Hong Kongese consumers.