Online Marketing is an aspect of marketing which continues to grow unabated. Especially in recent years, the immense growth defies any projection making books and journals written just 2-3 years ago appear outdated. The ever-changing digital landscape might make it difficult to keep up to date at all times, especially for marketers. Universities using relatively obsolete material to teach their students result in companies having to invest considerable amounts of company resources to train them just as they come out of university.

In this case, it is useful to gain a certain overview of the different characteristics of the digital landscape in specific countries. Germany is of particular importance, due to the sheer size of its market and influence. In order to develop a fitting marketing strategy, it is crucial to understand the intricacies of the culture present in the country. The varied digital landscape present in Germany offers diverse opportunities which allow companies to develop a competitive advantage in their respective industries.

State of E-Commerce

E-commerce experienced great results in Europe in 2019 with total revenue of 621 billion Euros and an approximate growth of 275billion compared to 2018. This is nothing new, however, as this amount of growth has been going on for years and is not expected to stop anytime soon.

Source: https://datareportal.com/reports/digital-2020-germany

One of the key players responsible for the development of digital marketing in Europe is Germany. Its large population of roughly 67.9 people is eagerly buying products online. In 2019 the total revenue generated in Germany’s retail e-commerce was 108.2 billion U.S. dollars. This makes Germany the 5th largest e-commerce market in the world, holding first place in Europe.

Source: https://datareportal.com/reports/digital-2020-germany

This, furthermore, only represents a small part of the total e-commerce in Germany, as this statistic solely encompasses physical goods being sold to a private end-user. Looking at the entire magnitude of German e-commerce with the inclusion of B2B services would result in a significantly larger number and this big market presents marketers with the option to make use of their talents.

Nonetheless, not every part of life in Germany is represented in a big way by e-commerce, the dimensions of the food and personal care sector, which includes food, beverages, medicine, cosmetics, and pharmaceutical and personal care products, falls behind the rest of Europe. While it is, for example, relatively common to see someone order takeaway in the Netherlands, such a scene is almost impossible to imagine in Germany. Germans would much rather drive to a restaurant, order food there, and take it home with them. However, some companies such as Takeaway.com have identified gaps in the market and are trying to leverage them, investing in their German branch to make getting takeaway easier and more widespread.Fashion, on the other hand, is growing without problems generating about 18.82 billion U.S. dollars’ worth of revenue in 2019. Just like people in most European countries, Germans enjoy ordering clothes online and having it delivered to their doorstep. Women, in particular, enjoy ordering T-Shirts on Otto and sending back nine out of ten due to an unsatisfactory fit. This highlights the room for improvement, as a company such as Otto will then have to put those already worn clothes in the second-hand section generating less profit. The total returns can be as high as 50%, these returns are also expected to be free of charge.

Internet accessibility and infrastructure

The reason behind such high revenue being created is the average German’s ability to access the internet whenever they desire. Being home to the highest mobile subscriber count in Western Europe with approximately 92 million broadband users, combined with the highest percentage of internet users of 93%, turns Germany into a sophisticated digital market. And while this does make Germany one of the world’s digital leaders, overall it still lags behind other digital consumer nations such as France or Sweden. German networks in particular can be quite outdated, with roughly about 1.5 million of the broadband connections being fiber-optic connections. Having a relatively slow or stuttering internet connection can be common for some parts of Germany as it ranked 35th in the world in August 2020 for average fixed broadband download speed with 41.95 Mbps and 34th for average upload speed with around 27.25 Mbps, although the German government is on its way to deliver a faster fiber-optic network to both rural and urban areas by 2025. The result of this is lower quality connection together with similar issues, which hinders customers ’ online experience. Certain aspects of online marketing are adjusted accordingly to fit the local situation such as slightly lower resolution in certain ads.

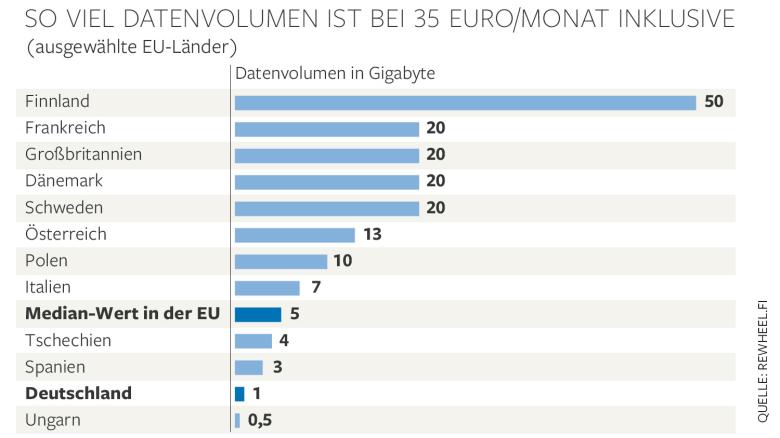

Especially when talking about mobile, in terms of digitalization Germany is far behind the rest of Europe. In order to get the same amount of broadband as in most other European countries, Germans would have to pay significantly more money which leads people to not wanting to watch videos while commuting.

Source: https://maelroth.com/2015/07/b2b-content-marketing-in-germany/

For 35 Euros a month the median volume of data that a mobile user in Europe has access to is 5 Gigabytes whereas the German consumer only gets 1 Gigabyte for that amount of money. In comparison, Germany’s neighbors France and Denmark get 20 Gigabytes and so does the UK and Sweden. Advertisers should therefore not opt for some of the more data-heavy formats if the target audience consumes content via mobile.

Devices

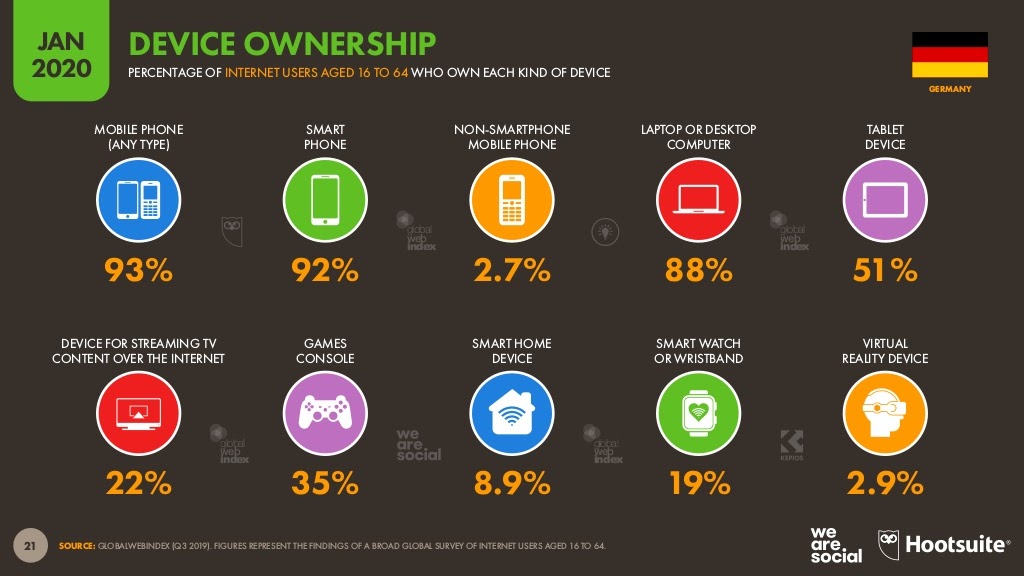

The choice of devices used by the average German consumer in order to go online is also noteworthy. Almost everybody has at least one phone, if not more in the case of having a separate phone for work. With over 92% of the population aged 16-64 being in the possession of a smartphone, Germany has the 9th highest smartphone penetration in the world and it is important for websites to adjust their design accordingly.

Source: https://datareportal.com/reports/digital-2020-germany

Nonetheless, Germans are not limited to their phones as there is a high penetration of tablets and personal computers as well. 88% of Germans aged 16 to 64 make daily use of their own computer or laptop and 51% use a tablet. Compared to the previous years, the top spot is taken over by smartphones with 92% of daily use in comparison with streaming over TVby 22% of Germans. Due to this diversity in devices, the choice of a website to use adaptive or responsive designs gains significant importance. The access to increasingly fast cellular connections combined with high disposable incomes drives incremental growth of online purchases in Germany. Nowadays Germans purchase almost everything online and the primary devices for this activity are PCs however they do increasingly use their smartphones, particularly while not at home as 34% of smartphone owners used it for shopping in 2019. This comes with stronger demand for multi and omnichannel approaches.

Just like the aforementioned takeaway services being increasingly offered in Germany, delivery services are generally experiencing an increase in urban areas.

Behavior

Not only do the technological advances influence the German consumer, but the German consumer also exerts a significant influence on technology. In recent years UX has become a pivotal element in web development in an attempt to decrease bounce rates. Germans like to give feedback and also to exchange information about digital services and products but they likewise demand to be taken into account. They have been doing this consistently over the last years on blogs, boards, etc. and inform themselves generally before making a purchase, with around 3.5 million people reading blogs and forums frequently and 8 million occasionally using them. The higher the price the more time is spent on comparing prices on multiple websites, even going to different price-comparison websites to get a better offer.

The other side of the coin is held by the always present desire for a high-quality product; It has to be as cheap as possible and as well-made as possible. Germans are essentially always trying to get their money’s worth and take pride in getting the best deal. They are, however, willing to ignore the price once the quality of a product is good enough.

All this leads to a company having to make sure to properly communicate the worth of their product to German consumers because if they do not the customers will quickly jump to the competition. On the other hand, once a company has established a reputation for its quality German customers will come back a lot more easily, even more so if the company can provide certificates of certain institutions in order to prove their quality to the consumer.

Security and transparency are important values, which together with environmental issues and social responsibility, are crucial to keep in mind while interacting with the German consumer. In comparison to countries like the U.S., where corporate social responsibility (CSR) is only slowly catching on, Germany is already largely on board. It is always good for marketing targeted at Germans to contain a little bit of CSR if not more. Together with transparency, these values are received positively by the consumer and help to improve a company’s PR quite a bit. Germans prefer a straight message that does not beat around the bush.

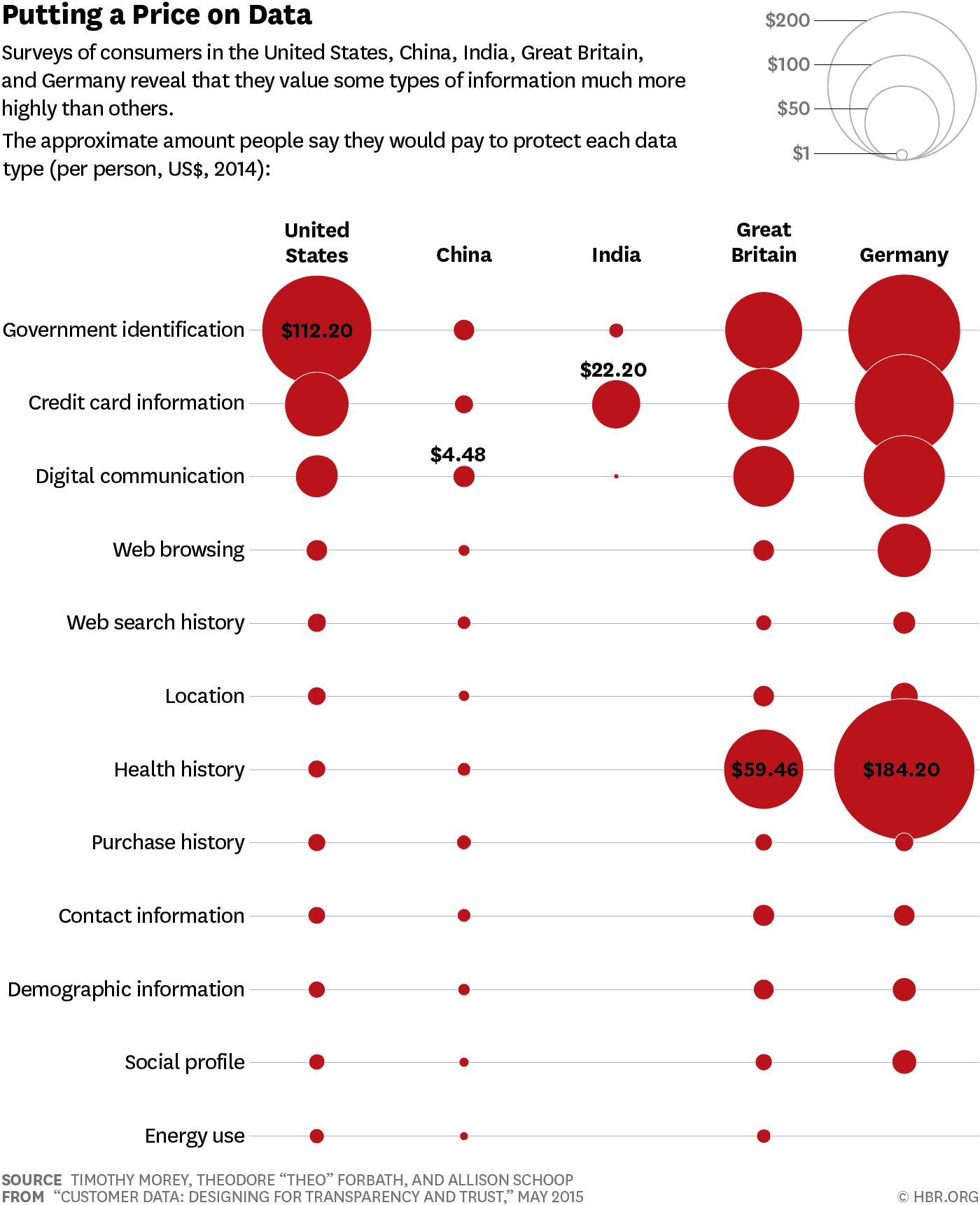

Likewise, it is important for a company to convey its stance on data security if they are handling sensitive information. While a lot of this depends on the different types of data being handled, it can be generalized a bit and it turns out that Germans do not want any of their data to be shared or sold to others parties whether this data is anonymous or not.

Source: https://maelroth.com/2015/07/b2b-content-marketing-in-germany/

Most Germans know that Facebook collects and sells all kinds of data and they are not particularly happy about it. In terms of security, Germans might also take a thorough look at an unfamiliar website before making a purchase.

Payments

Germany is still a cash-based society. While most Germans either have a debit- or credit card, they still mostly pay by cash since they have limited alternative choices. Of course, any shop where the customer has to spend a larger amount of money has the option to pay with a card, but the bakery on the corner probably does not. Even bakery chains with shops in the high double digits might not necessarily have card payments as an option, unfortunately this also translates into the online world. Whereas Germans do use online payment services for purchases on the smaller side, they prefer to make bigger purchases on account with over 60% preferring to pay by invoice. Once more taking the takeaway as an example, many restaurants only accept cash on delivery and do not offer services such as PayPal or credit card on their websites.

Digital Marketing

German digital marketing has its own unique characteristics which is due to the culture and mentality which is present in Germany. The aforementioned demand of the German consumer for detailed product information is mirrored by the advertisements in German media. As such, German ads list the features of a product and not necessarily its benefits, while maintaining a neutral tone of voice. The products are analyzed and described. Impersonal sentences are typical and formal language with the use of the “Sie”, a formal version of “you”, is dominant. There is also a specific emphasis on the type of features that are being described. Taking food as an example, a typical German ad would put more emphasis on nutrition than ads from other countries, which might put more emphasis on the packaging or the feeling associated with the food.

Source: https://datareportal.com/reports/digital-2020-germany

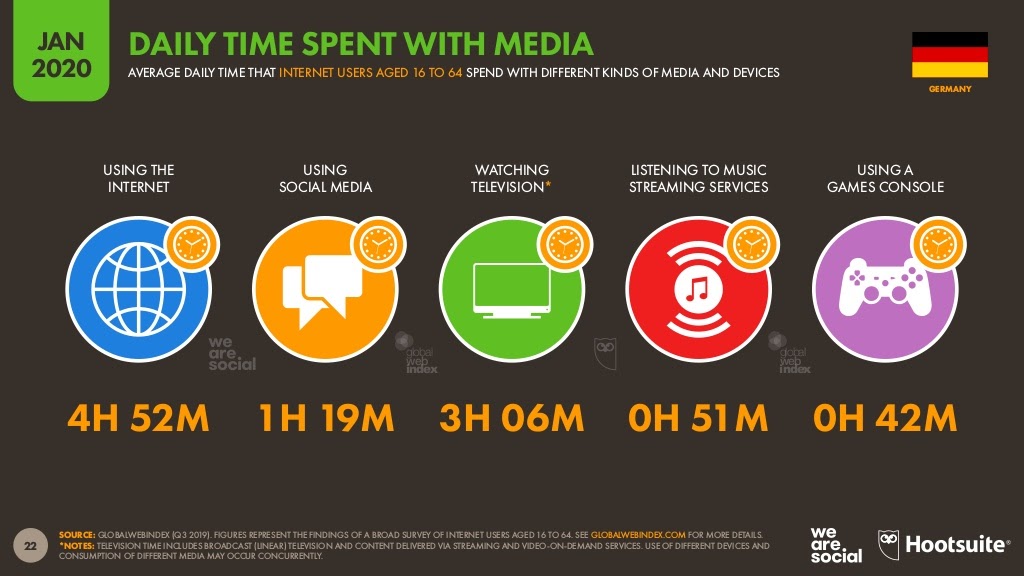

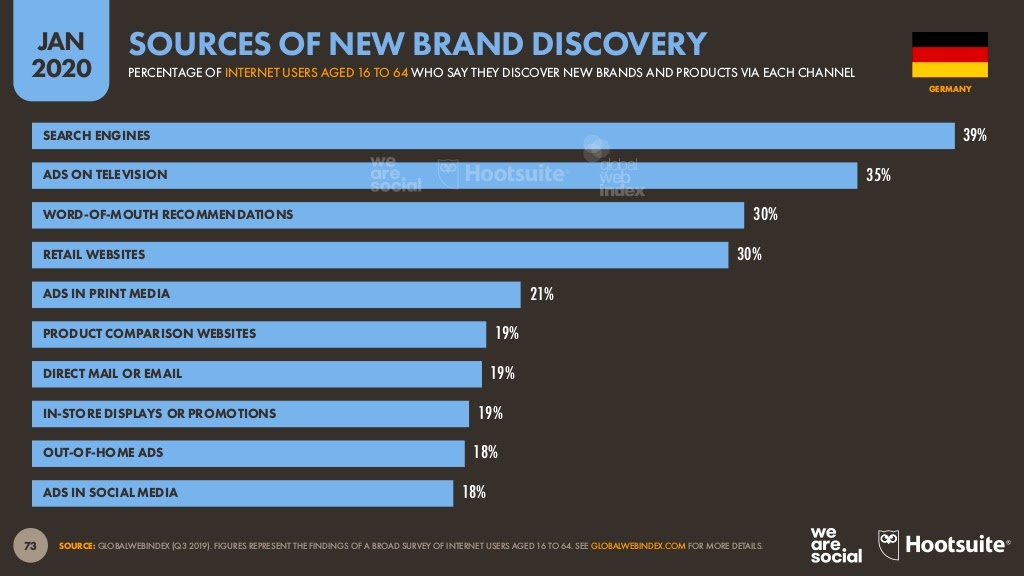

There is also a shift in what type of media Germans consume. Traditionally, Germans have a passion for TV and its ads, but as the country’s interpenetration rate increases, so does the amount of time each German spends surfing the internet.. While the total media ad spending in Germany has steadily increased by about 10% from 2018 to 2019 the expenses for TV-advertisements are behind the digital ones .

TV-advertisement’s growth has slowed down significantly as it used to make up more of the total ad spending in Germany with 35% of the total spending in 2019 while digital made up 39% in the same year.

Source: https://datareportal.com/reports/digital-2020-germany

Source: https://datareportal.com/reports/digital-2020-germany

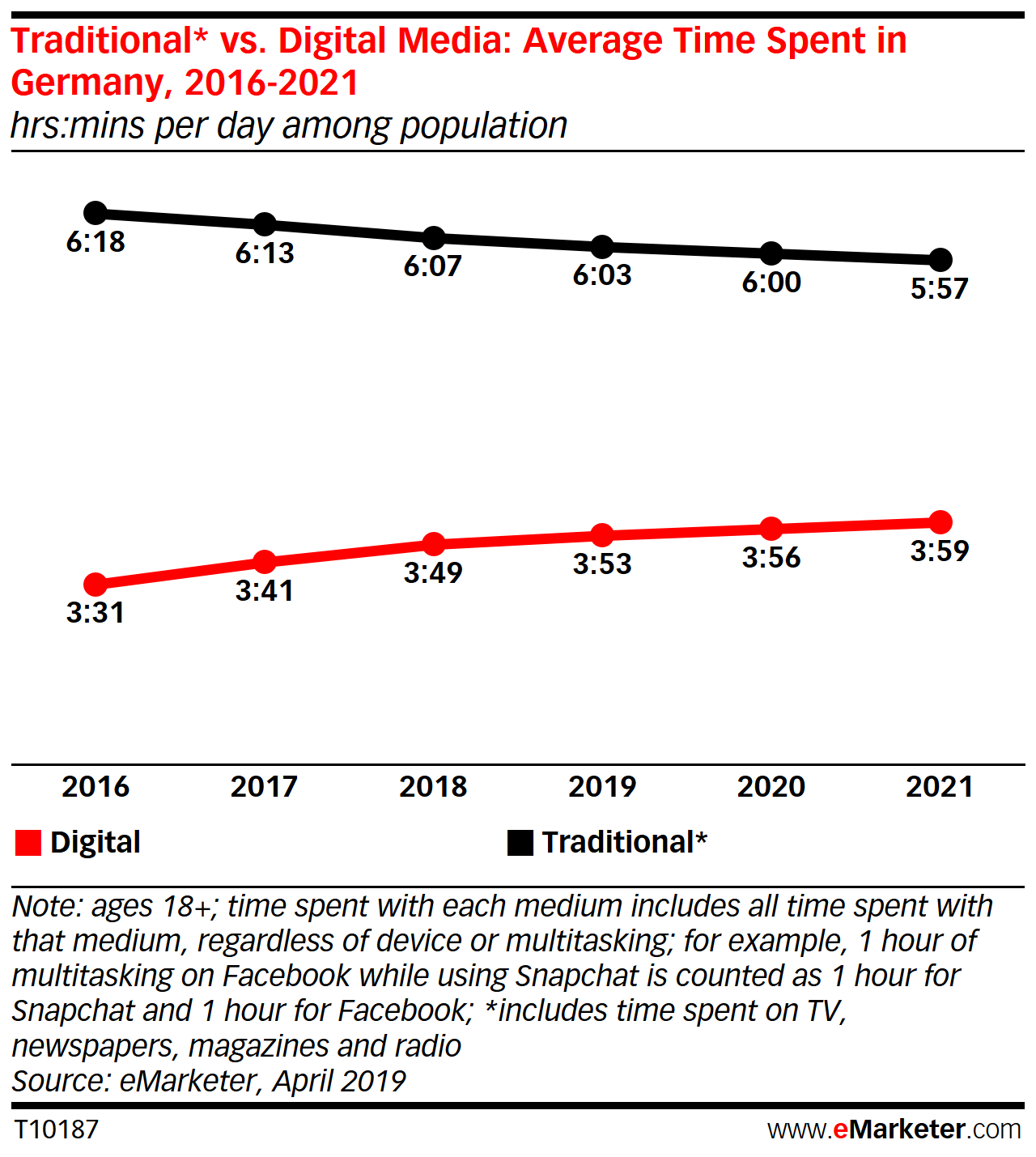

Although, not everybody has sworn off the TV with car manufacturers still investing heavily in television ads. This holds true, Germany’s population is the sixth oldest population in the world with a median age of 45.9 . But, from the year 2017, the older population of Germany have devoted more time surfing the internet than watching TV.

Source: https://www.emarketer.com/content/germany-time-spent-with-media-2019

With this, digital ads spending continues to increase, reaching over 15.56 billion U.S. dollars in 2019. A German aged between 16-64 spends 3 hours and 6 minutes watching TV and 4 hours and 52 minutes surfing the internet on a daily basis.

A major reason for this development is Germans spending more time on mobile devices for shopping, social media and more with 16-64 years old spending 292 minutes on average every day on the internet. This signifies an increase of 15 minutes from 2018 to 2019. Streaming services make up a large portion of this with YouTube, Netflix, Twitch and Amazon Prime taking the forefront, but Podcasts and Spotify are similarly experiencing an increase in popularity. These tendencies allow for specific segmentation of the typical Germans daily use of their time, which in turn is taken advantage of by advertisers with highly targeted ads.

There are certain online shops that are worth mentioning such as Amazon and Otto who together make up more than 50% of German B2C online sales. Behind those giants, there are still some dominant players that should be kept in mind. These are Media-Markt, Zalando, Apple, Alternate and Tchibo. The chances for a general retailer to break into the German market are slim due to the high barriers of entry, but chances still exist for specialists and artisans.

Despite Germany being ranked 10th among the 100 countries supervised by EF for English proficiency, the main language for communication is German. It is also important for a website to be properly translated if it wants to appeal to German-speaking customers. The German language might have a multitude of words for only a single English counterpart and it is important to keep this in mind as Germans scrutinize a website very closely before starting to put their trust in it. However, when a website does contain proper translation it can also be useful for the other five countries in Europe which have German as one of their national languages. Also, despite Germany being home to tens of dialects the online world solely runs on a single type of German, which is known as High German or just Standard German. It is taught in every school and spoken by everyone.

SEO

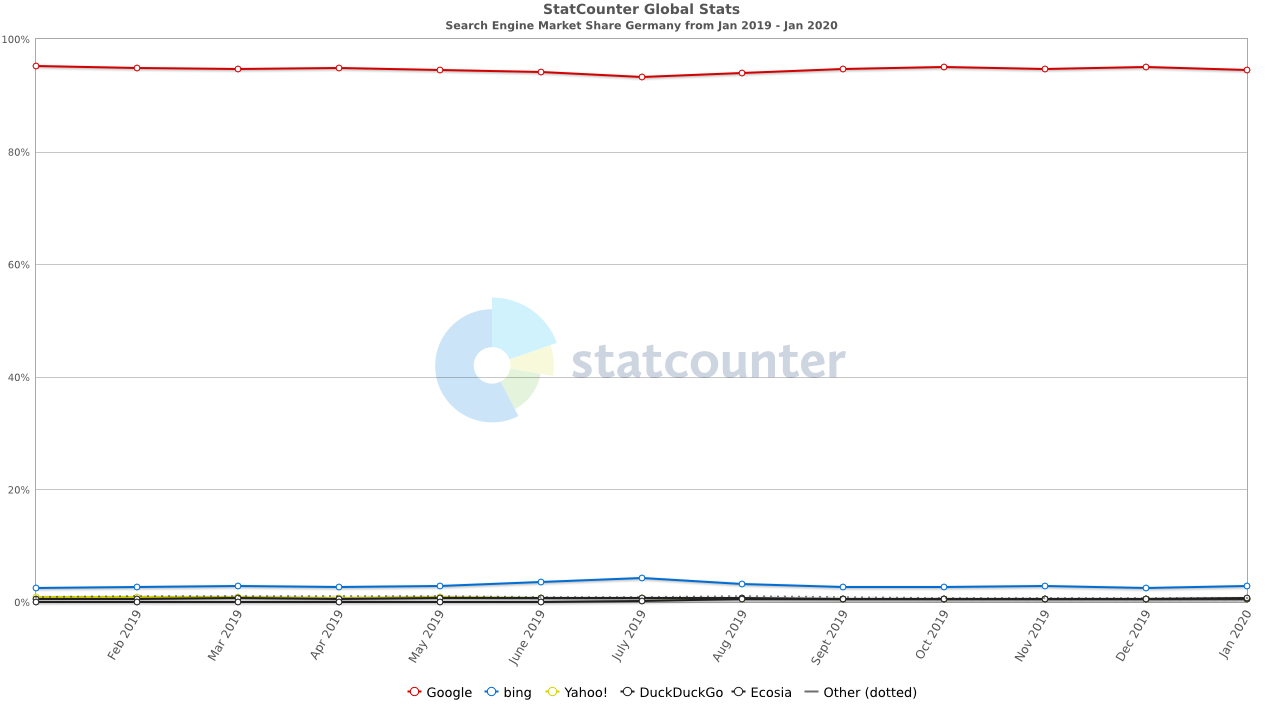

Germans make strong use of search engines with over four billion searches every month, more than 95% of those are made with Google.

Source: https://gs.statcounter.com/search-engine-market-share/all/germany/#monthly-201901-202001

Even though the top 20 search queries in Google in the year 2019 were mostly one-word searches, long-tailed keywords are increasingly effective in producing SEO results as they can produce more significant results. One of the reasons why search queries are becoming longer is because of voice searches done with Siri and even more so with Alexa.

As already explained, Germans prefer more descriptive content. They are also positively inclined towards their local products, meaning they are loyal to local manufacturers and favor German-made goods. Normal SEO tactics are sufficient in order to appeal to the German consumer, it is however advisable to use German hosting as German domains are expected by the consumer with the only exceptions being for major international brands such as Facebook. Marketers use criteria that might be ignored by others such as making active use of Google’s Spam Report index. They engage with crawlers that evaluate the anchor text of all available external links, furthermore monitoring performance after a link is established.

As a side note, SEO consultancy is relatively new in German with most companies only being three to four years old, with the firms generally only having two to five employees.

Social Media

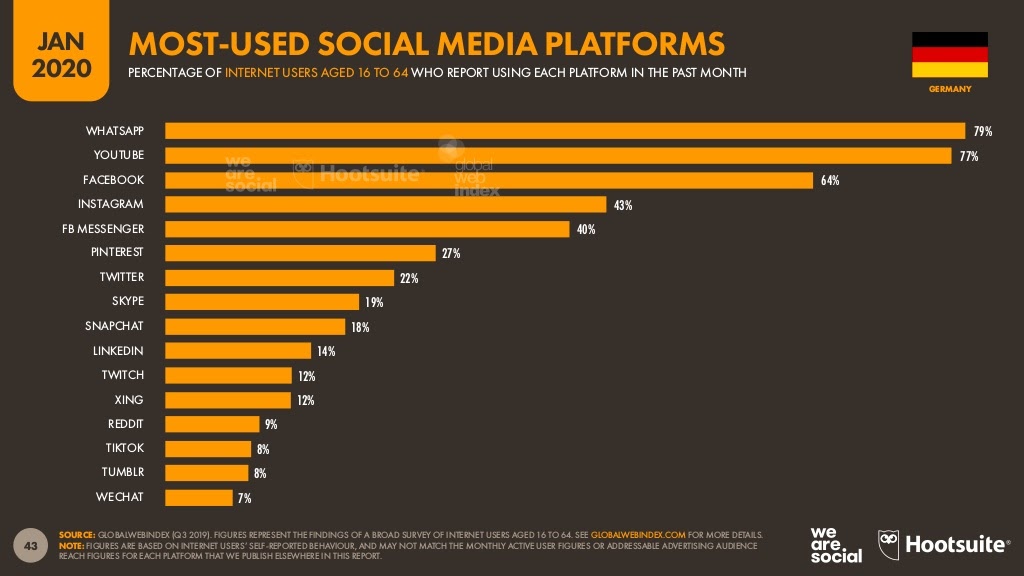

Social media in Germany is not as predominant in comparison to other top OECD countries. Out of 38 million social media users in Germany, 94.8% are adults. Out of those, 48.7% are between 18 and 34 years old with only 46.1% of Germans older than 34 are active on social media. This signifies the increase of the older population using social media in the country, meaning a lot of lost opportunity for marketers. The importance of social media is nonetheless on the rise with more and more people using its services.

The most popular social media network is Whatsapp with 79% of Germans ages 16-64 using the platform on a monthly basis. It is followed by Youtube with 77%, Facebook by 64%, Instagram by 43%, and FB messenger by 40%. Instagram’s rise is particularly big with an increase of 10% from 2018 when only 33% of Germans used Instagram on a monthly basis.

Source: https://datareportal.com/reports/digital-2020-germany

Source: https://datareportal.com/reports/digital-2020-germany

Other noteworthy networks in Germany, albeit slightly less significant, are Pinterest, Twitter and Skype. Pinterest is used by 27% of the population ages 16 to 64 on a monthly basis, Twitter by 22%, and Skype by 19%. Looking at it as a whole, the German use of social media is steadily rising over the years.

It might be important to mention that Germans like to keep their private life and business separate. Despite increasing in number, only about 41% of German companies are making use of social media for their own marketing. Bigger companies with over 250 employees make use of it more frequently (72%) than smaller companies (43%). Marketing communication is no longer about the delivering of messages through media channels and more about managing links between people.

Conclusion

After taking the different aspects of the German digital landscape into account, it becomes apparent that the country has a distinct character. The German preference for descriptive advertisement should be kept in mind and used as an advantage. Simply replicating strategies used in other countries does not guarantee success. Germans desire for quality goods is another key aspect worth noting, as quality is more important than price to many Germans. Most aspects of the German culture are easy to grasp and understand. They will want to get a good deal, but if the product offers good quality, they are more than willing to pay extra. The sheer size of the market, combined with the universal access to the internet allows marketers to make use of the many opportunities, connecting them to their target audience. Marketers have noticed this, with 36% of European marketers willing to move to Germany in order to advance their career.

Featured Photo by Stefan Widua on Unsplash

Thank you for such a great blog.

You’re welcome =)