Japan is the third largest luxury market in the world – behind the United States and mainland China – with 3.01 trillion yen (about $28.6 billion) spent each year in luxury goods. The luxury industry encompasses various sorts of goods such as drinks, fashion, cosmetics, fragrances, watches, jewelry, luggage, and handbags. In the past few years, this market experienced a steady climb in Japan.

Image source: https://www.japantimes.co.jp/news/2012/09/05/business/daimaru-reopens-larger-store-near-tokyo-station/#.W5Dt9OgzaUk

This upward trend in Japan’s luxury marketing has opened a world of opportunities and possibilities for companies in the industry. To tap into these opportunities, businesses employ different marketing strategies. Among these strategies, the latest and most advanced is digital marketing.

Luxury labels are built on exclusivity, which used to mean that having an online presence was not necessary within the circle of existing shoppers. However, now that most of their customers are online, it’s imperative for luxury brands to dive into the web along with their shoppers.

This is why it’s essential for luxury brands to use digital marketing. Digital marketing involves using digital channels such as search engines, social media, email, websites and mobile apps to connect with existing and potential customers and is often used by companies for leverage in the market.

Japan’s luxury industry

Japan’s luxury goods industry steadily rose again a few years after it had a major downturn. With the global financial crisis in 2011, followed by the disasters in Tōhoku and Fukushima, luxury spending in Japan shrank by over 1 trillion yen ($10.6 billion) in 2012.

Today, Japan’s luxury shopping scene has changed. As mentioned earlier, Japanese shoppers are now spending 3.01 trillion yen (about $28.6 billion) annually on luxury goods.

In a report by Statista, the Japanese luxury market is expected to maintain its positive growth annually by 5.7 percent. By 2021, the country is expected to have a spending of $30.4 billion on luxury goods. This forecast by Statista was adjusted in July 2020 to anticipate further impact of the COVID-19 pandemic.

Six companies from Japan helped the country to rank third in the highest annual composite luxury sales growth worldwide according to the 2019 Global Power of Luxury Goods 2019 report by Deloitte. Shiseido Prestige & Fragrance, Ḱose Corporation and Onwards Holdings had a 67 percent share of the total luxury sales of Japanese companies. The country had a sales growth of 14.1 % compared to the previous years, which was driven by increased wages and employment along with the increase in the number of women entering the workforce. Additionally, the demand for luxury goods from both domestic consumers and tourists also increased from 2017 to 2019 due to the efforts of the Japanese government to attract inbound tourists for the incoming Tokyo Olympics 2020..

But in 2020, the world faced a global collapse caused by the Coronavirus 2019 (COVID-19) pandemic. Lockdowns were put in place around the world resulting in the shutdown of several tourism markets. The luxury goods market faced a challenge it has never dealt with before, experiencing a 25 % worldwide decline in the first quarter of 2020. According to Boston Consulting Group (BGC), the global personal luxury market could lose $33 to $44 billion in sales (€30 to €40 billion) this year.

Image source: https://www.bain.com/insights/luxury-after-coronavirus/

Luxury sales in Japan have also declined. Japanese department stores, the main venue of purchase for Japanese luxury consumers and tourists, have seen sharp drops in spending. Free-spending Chinese tourists, one of the top contributors to the rise of Japan’s luxury goods market, can’t shop and visit more often than before due to some travel restrictions and safety concerns. However, they have been struggling for the past decade, undergoing a 4% annual decline in sales between 2010 and 2016.

According to Bain & Company, the reverberation of the sales in the luxury goods industry will probably last until 2021. The slow decline of sales in Japan will probably stabilize in the last quarter of 2020 or first quarter of the year 2021.

Image source: https://www.bain.com/insights/luxury-after-coronavirus/

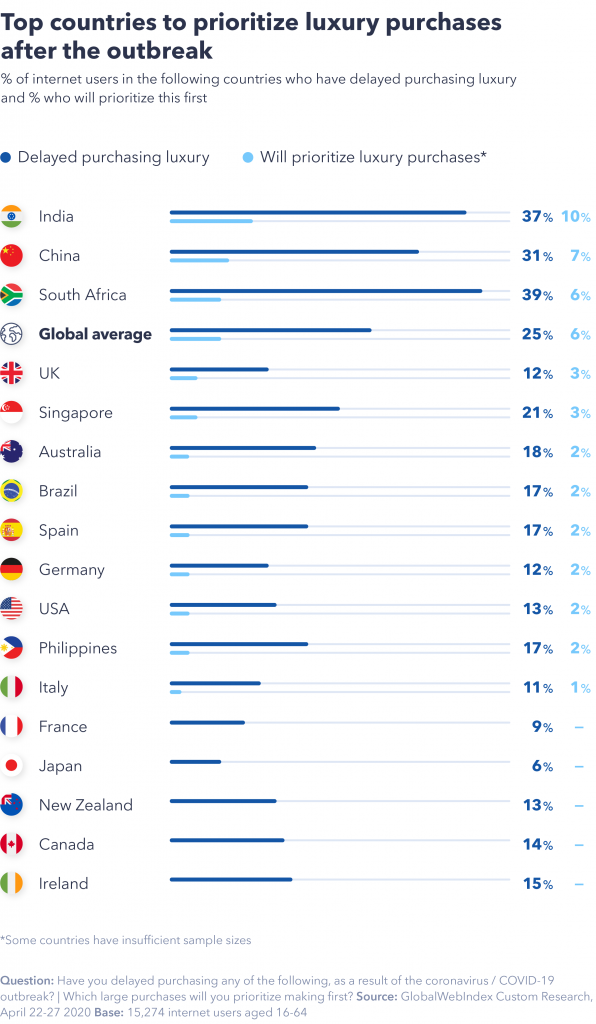

In the custom report based on a survey done by Global Web Index last April 22-17, 2020, Japanese locals ages 16-64 will most likely to delay purchasing luxury goods after the pandemic.

Image source: https://blog.globalwebindex.com/chart-of-the-week/coronavirus-reshaping-the-luxury-market/

The future of the luxury industry’s upward climb after the pandemic is likely to be driven by the increased role of the Generation Z aged 5 to 25 and Millenials. Millennials are observed to be more enthusiastic about luxury spending and less reluctant to show off than the other age groups, while Gen Z are most likely to devote half of their time to making a purchase either seeking inspiration or inspiring others. The younger generation is buying brands like Céline, Balenciaga, and Gucci, which are sought-after all over the world.

Those from the older generation are purchasing from brands like Hermès and Chanel, which are perceived as “very reliable” and “have a heritage.”

Digital marketing in the luxury industry

With the recent decline in the Japan luxury market, physical stores of luxury brands have been transitioning to digital and online shops. During pre-COVID-19 times, Japan actually accounted for 4.4% of global luxury spending and has remained a major profit driver for many established luxury players.

Thus, it is critical for relatively unknown brands, and even for established ones, to stand out among the numerous luxury labels.

Digital marketing is one of the possible strategies to be visible and reach existing and potential customers from 2020 onwards. The rapid shift in online transactions spurred by the COVID-19 pandemic has caused online sales to spike. So, luxury brands are focusing on creating interactions with customers due to shortened physical store hours. This is important for Japan as one third of their population are senior consumers who spend their time shopping at physical stores.

It’s understandable why luxury companies are cautious to go digital. But with decreasing returns from print and display advertising and luxury shoppers spending more time online during this pandemic, luxury brands need to adapt to the digital world if they want to survive. Here are several digital marketing techniques that are currently trending in the luxury industry in the face of the COVID-19 pandemic.

Going Local

The COVID-19 pandemic brought up a global disaster financially. It limited people’s movements into a small space, their homes. The pandemic reduced their regular commute, travel itineraries, and even daily routines such as jogging and buying groceries from physical stores. To increase economic stability, every country affected by the virus started to focus more on their locally-produced goods and their people.

As countries become locally-oriented, luxury brands need to understand this shift and focus on how they can target their local consumers instead of tourists using digital marketing. Brands should take into account the consumers’ change in lifestyle, the new normal, and a shift from mobile back to desktop in how they consume digital.

Product-Driven Live Streaming

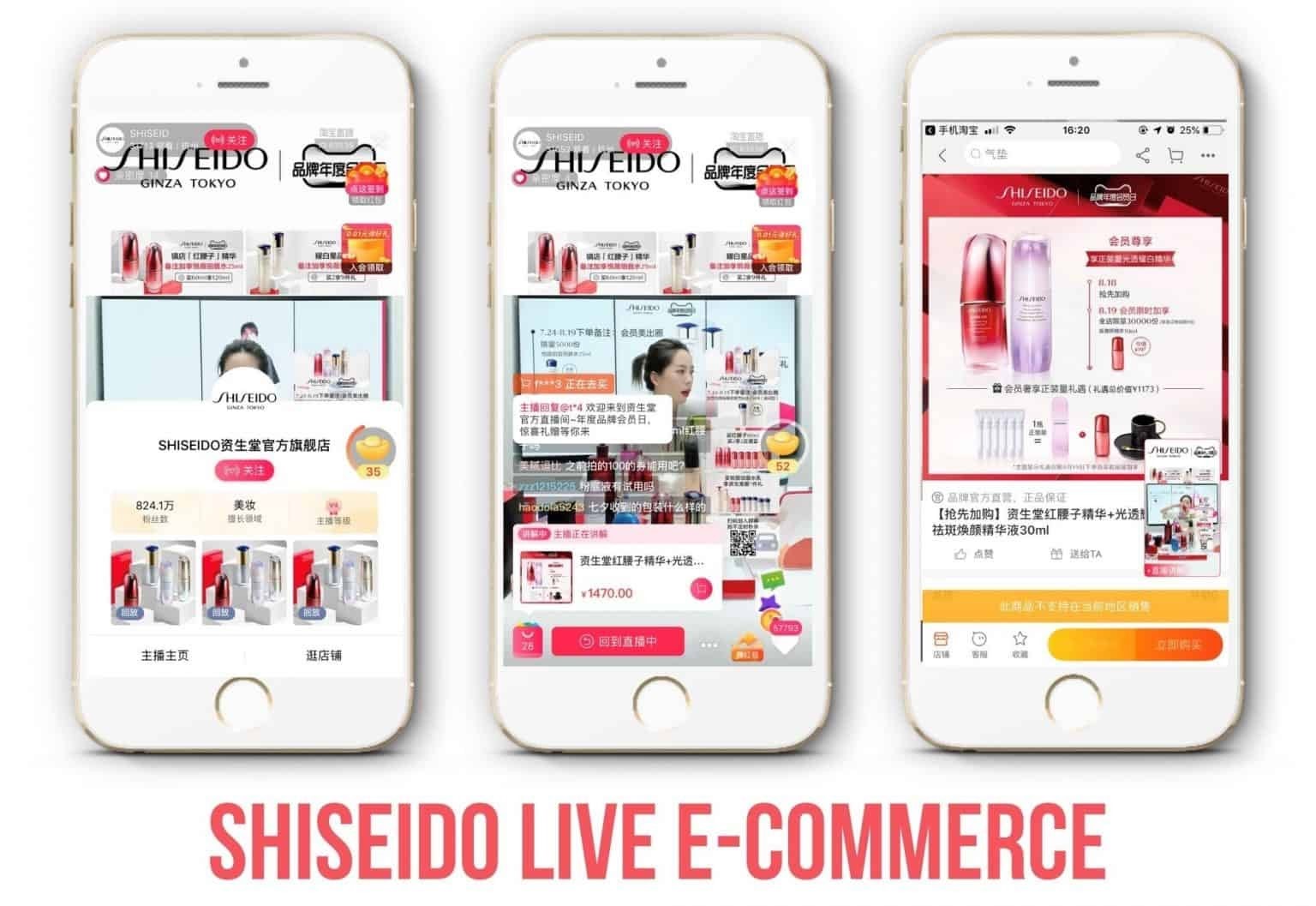

Live streaming has been a popular digital marketing trend in Asia, especially in China, for some time. It’s basically live-streaming shopping. This technique allows luxury brands to reach their target audiences with their digital in-store experience. It’s also an opportunity for brands to improve their current customer relationships and increase their loyalty, and to gain new customers by giving them a more realistic and detailed approach when it comes to online shopping. Plus, brands will have the advantage of selling their products directly in the app of their choice. They can attach a button or link that will direct the users in their online stores.

Product live-streaming usually works well when influencers such as KOLs (Key Opinion Leaders), KOCs (Key Opinion Consumers), or celebrity endorsers are involved. Their audience can significantly increase brand awareness and improve the sales of the brand’s products and services.

In the midst of the COVID-19 pandemic, many Japanese brands, both luxury and non-luxury, have been trying this new approach. A great example is Shiseido. Shiseido has conducted live streaming sales programs promoting its products in the Chinese market, the first market to rise amid the COVID-19 pandemic. Because of this, the company’s e-commerce sales remained strong. They trained beauty consultants to use live-streaming in social media to promote their products, worked more closely with their retailers on a better technology-based shopping experience, and are investing more on digital marketing.

Image source: https://www.marketingtochina.com/japanese-companies-use-live-streaming-to-increase-sales-in-china/

Interactive Social Media Ads

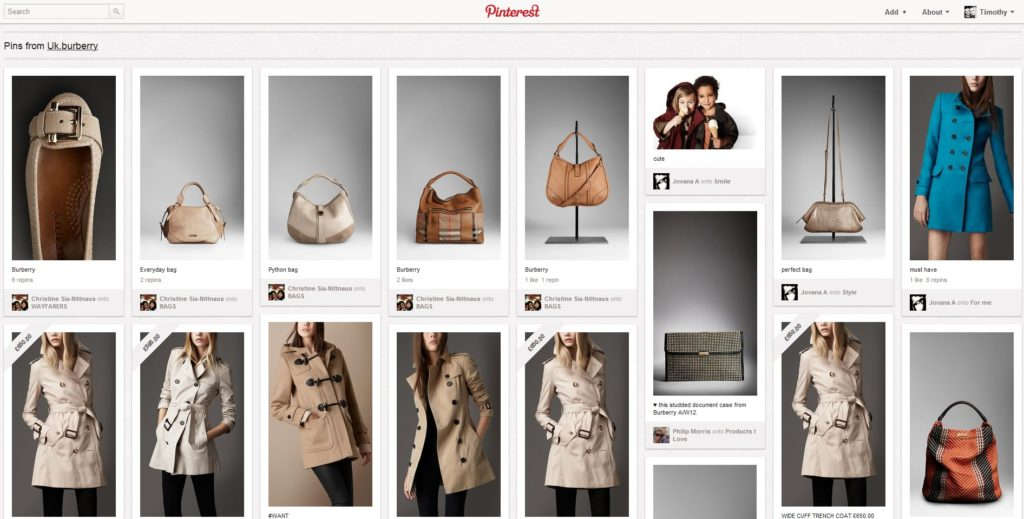

Visual social networks like Pinterest, Facebook, and Instagram provide a huge opportunity for luxury brands to raise brand awareness and advocacy, since photographs and videos are one of the best media for marketing luxury products. Images and videos evoke the aspirational emotions that can be connected with driving a luxury vehicle, wearing designer clothing, or being a part of something exclusive.

In fact, Chanel is one of the most ‘pinned’ brands on the social network, with over 1,244 pins of Chanel products pinned on the social network per day on average in 2013.

Burberry has actually partnered up with Pinterest, the biggest beauty platform in the world, in providing a personalized experience in the social media site. They are the first luxury brand to do so!

Image source: https://www.launchmetrics.com/wp-content/uploads/2016/09/Pinterest-2-1024×519.jpg

Other than Pinterest, Instagram and Facebook are also effective channels for luxury brands to showcase the prosperous lifestyle and designer tastes of their target market. The power of advertising through Facebook should not be underestimated. Due to the high level of segmentation and targeting that it permits, Facebook Ads are one of the most effective forms of online advertising.

Boost SEO

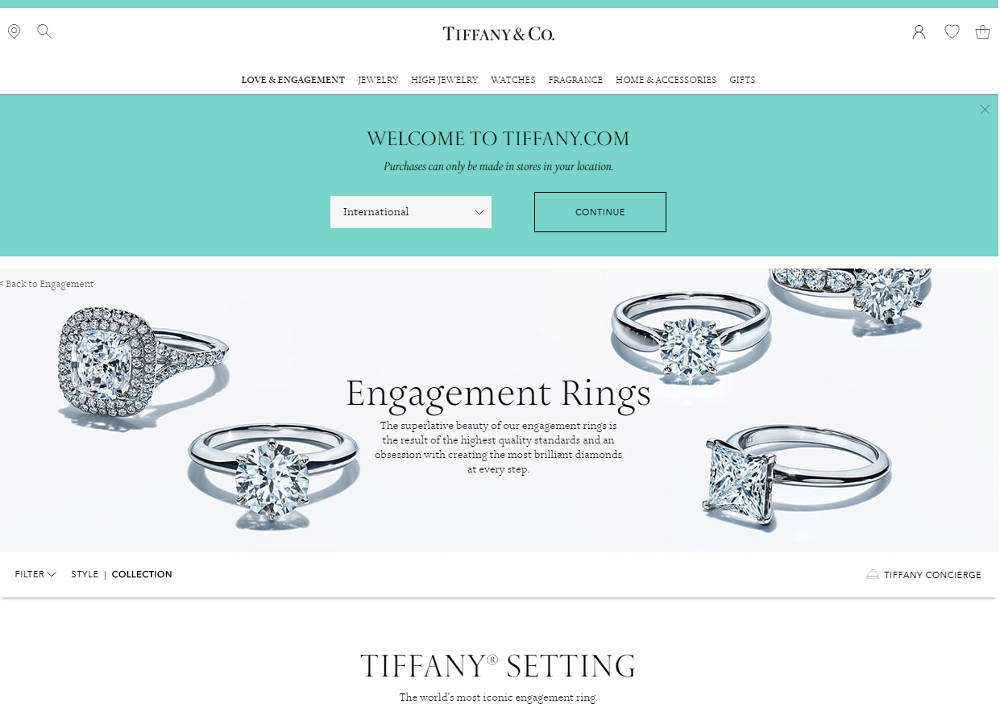

A well-executed SEO strategy is one of the most lucrative digital marketing investments that a luxury company can do. Google is one of the most significant channels for luxury shoppers to find products, discover more about brands, and make their purchase. In the past, luxury brands relied mainly on brand awareness to drive sales. This has changed recently since a large proportion of luxury brands have begun investing in SEO strategies.

SEO is beginning to be recognized as a legitimate source of revenue with the growth of the digital industry. Some jewelry brands, specifically Tiffany, have bought into SEO and now have firm, successful strategies which have led to them dominating the search results. As a matter of fact, Tiffany was one of the first luxury brands who took online marketing and online sales seriously, and this strategy has apparently paid off.

Luxury companies are reaching a critical point where they must either adapt or risk losing ground to a growing number of competitors. Nonetheless, there are still a lot of other factors that determine the success of luxury brands in the digital world.

Tap into Japan’s luxury industry with digital marketing

In a nutshell, Japan’s luxury industry continues to open a world of possibilities and opportunities for luxury brands despite the challenges brought on by the pandemic. In order to stand out amid competition as well as reach out to the target market, it is essential for luxury companies to employ necessary digital marketing strategies.

More and more consumers in the luxury goods market are going digital, thus luxury brands must adapt as well.

Several digital marketing strategies have been proven to be effective in the luxury goods industry; this includes content creation, social media marketing, and SEO optimization.

Info Cubic Japan has many digital marketing solutions for tapping into the opportunities in Japan’s growing luxury goods industry. Contact us today to get into Japan’s market with success.

Featured image by Ana Rodriguez