The People’s Republic of China is undoubtedly one of the leading drivers of the modern digital age, both in Asia and on a global scale. The country has Standard Chinese as its official language and holds one of the largest middle-class in the world. With its 1.44 billion population, the Chinese market is a massive site of opportunity that is highly-coveted and invested in by international brands.

Digital marketing in China holds many opportunities for exploration and the integration of new technologies. In fact, data from eMarketer show that advertisers will increase their digital ad spend to 5% for this year despite the pandemic’s disruptions in China’s economy.. That brings the estimated ad spend to a total of $75.33 billion. With consumers’ comfortability with online shopping and the blurring lines between social and e-commerce, marketers are now seeking strategies that focus on social commerce.

With the tech-savviness of Chinese consumers, cheap broadband, and a dynamic online landscape, the digital marketing industry will continue to thrive. However, marketers must note that an all-in-one approach will not work for such a massive and diverse market like China. Certain planning and strategies must be developed in order for brands to generate visibility and engagement in the Chinese market.

This article will discuss China’s digital marketing environment, industry challenges and opportunities, successful campaigns, as well as the best possible ways of reaching the Chinese audience.

Digital Landscape of China

China holds one of the largest markets in the world. According to the 2020 Global Digital suite of reports from We Are Social and Hootsuite, 854.5 million residents are internet users, with a total penetration rate of 59%. Additionally, there are 1.04 billion users of active social media users in the country. This means that social media are heavily integrated in the Chinese online landscape,holding a 72% penetration rate.

Source: https://wearesocial.cn/digital-2020-china/

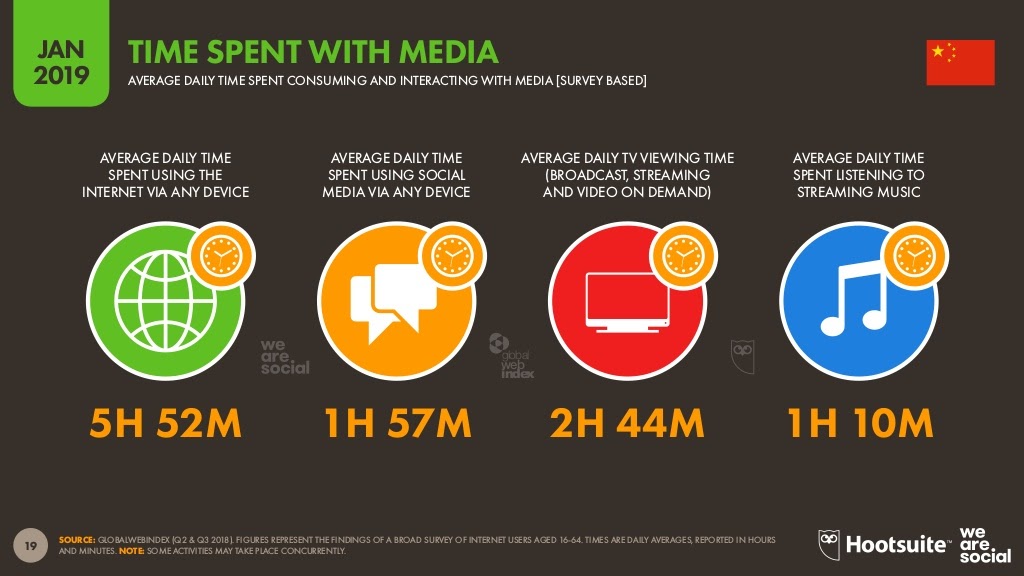

On average, Chinese users spend nearly 5 hours and 50 minutes accessing the internet daily and approximately 2 hours and 15 minutes on social media.

Source: https://wearesocial.cn/digital-2020-china/

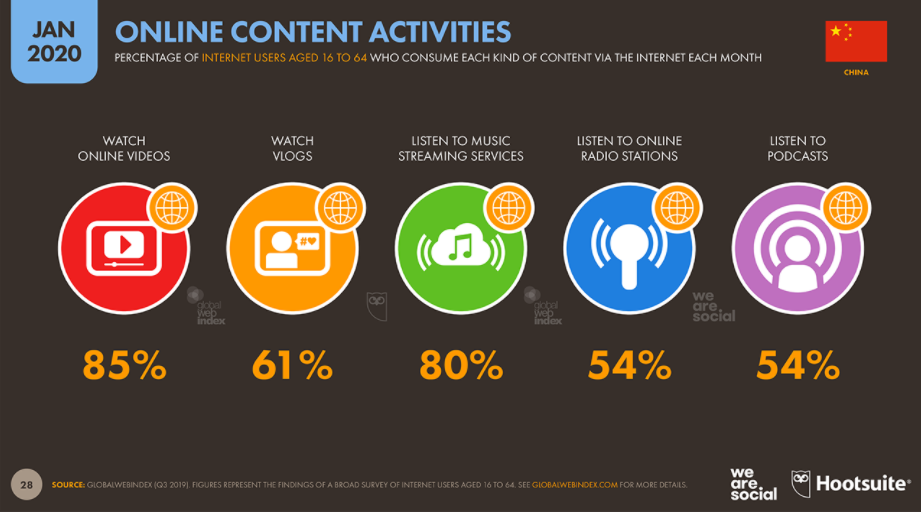

Additionally, short video content is a popular and effective trend used in digital marketing strategies. This coincides with the statistics below which shows watching videos as the dominant online activity, with 85% watching online videos and 61% watching vlogs.

Source: https://wearesocial.cn/digital-2020-china/

Chinese consumers purchase online avidly, with an estimated 73% of the population searching online to buy goods or services, while those that visited an online retail store and purchased online are at 93% and 78% respectively.

Social commerce holds enormous potential in China. Consumers don’t want to simply shop online; they also want the experience to include social media. Therefore, mobile purchases are becoming the norm.

Source: https://wearesocial.cn/digital-2020-china/

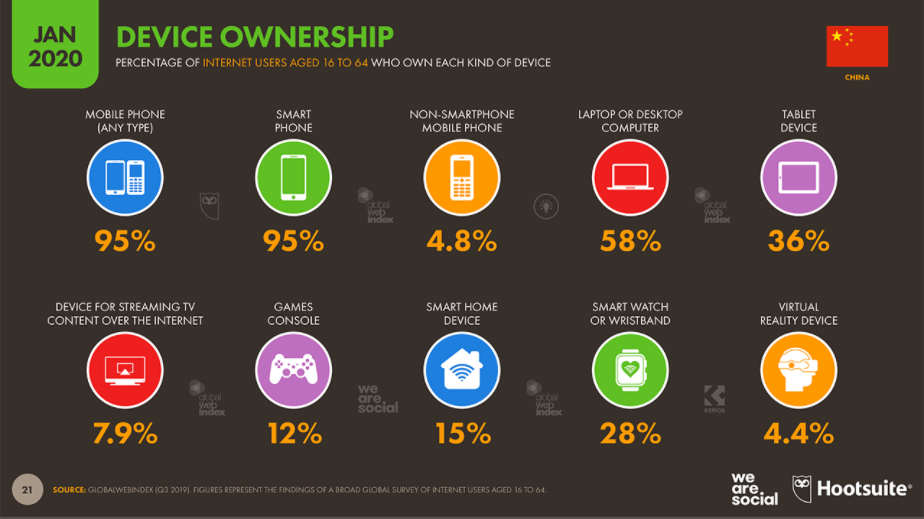

Chinese consumers have shifted from desktop computers to mobile phones. 95% of residents own a mobile phone. With 95% of the population accessing the internet through their mobile devices, China is the first country to be a “Mobile First Nation.” In 2019, Chinese users installed an average of 56 applications and spent 4.7 hours on mobile apps per day. This means that Chinese consumers are getting more and more distracted.

Source: https://wearesocial.cn/digital-2020-china/

The online landscape of China is geared towards mobile. Therefore, it is essential that marketers optimize their campaign strategies accordingly.

Biggest Channels

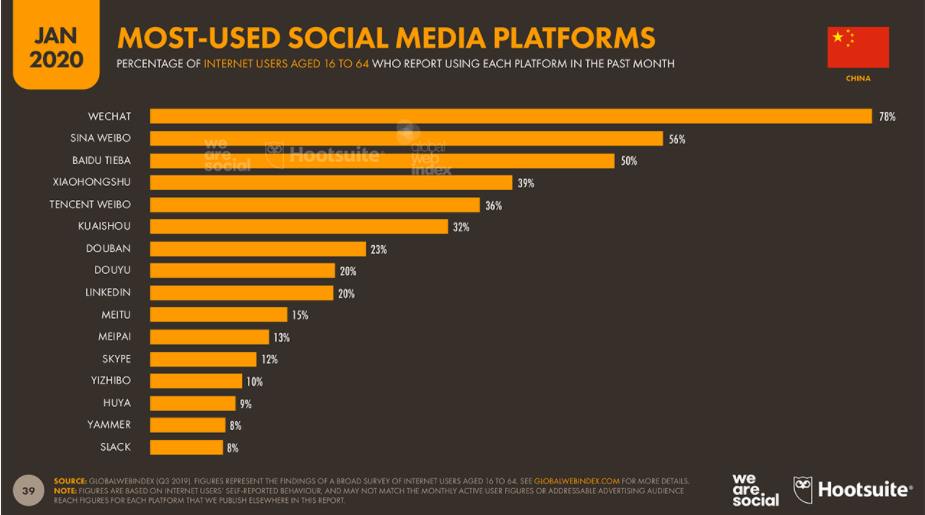

In most Asian countries, local channels dominate the online sphere, and China is no different. Interestingly, most of these platforms have been developed to hold a multi-purpose function that caters to both the consumers’ social and purchasing needs. The apps and sites that have integrated this trend now enjoy the top positions as one of the most active social media platforms in the country as of January 2020. Here are some of China’s biggest online channels.

Source: https://wearesocial.cn/digital-2020-china/

Developed by tech giant Tencent, WeChat is one of the most important channels in the Chinese digital marketing landscape. As of Q2 2020, the app now holds a whopping 1,206.1 million monthly active users and an estimated worth of RMB26,714 million. Now, the app transitioned to include games, online shopping, and even financial services, and is described as a mix of Facebook, Instagram, Skype, Uber, Amazon, and Whatsapp, plus over ten million third party apps.

Additionally, the app’s focus on e-commerce has proven successful. It now has features to hail taxis as well as mini-brand apps that offer discount coupons, taxi rides, and many more. WeChat also lets international brands subscribe to the app and create their own public accounts. However, third party links are not allowed within the app. To address this problem, marketers may collaborate with influencers to reach WeChat users.

For delivering news feeds ads, WeChat is also the country’s top platform. Marketers should note that mobile newsfeed are 24% of the total news feed advertising in China, and this rate continues to grow.

The versatility of this app, added with a massive user base, makes for a potentially rich source of customer engagement. As such, WeChat has great potential for more growth in the digital marketing realm.

Baidu Tieba

Instead of Google, the biggest search engine in China is Baidu, which has a 50% penetration rate as of January 2020. Such as the trend in the Chinese online environment, Baidu is currently developing a multi-purpose function that is posed to boost revenue and increase its user base. According to Baidu Chief Executive Robin Li, a new stage for the Chinese internet is already in play and therefore needs technological innovation to drive growth. Currently, Baidu is looking to integrate streaming and new technologies, specifically artificial intelligence (AI). These AI capabilities will include smart speakers, autonomous driving, smart transportation, among others. Furthermore, these investments in AI are geared towards increasing its user base and revenue growth.

In 2019, Baidu announced that it reached a $15.429 billion total revenue, with a 3.72% increase from 2018. Additionally, the app version has seen an increase in its daily active users count with a 20% increase year-on-year. In December of the same year, the number had reached an estimated 195 million active daily users.

Tencent QQ

QQ is another instant messaging app developed by Tencent that has also incorporated services like games, online shopping, and voice calls. Unlike WeChat, the app is more popular among white-collared workers and has a younger user base compared to other platforms. As of 2019, Tencent reported that it accumulated monthly active users of over 647 million. Although it has yet to beat WeChat, its massive hold on the Chinese market means that marketers should not overlook this channel especially for social media marketing.

The popularity of QQ lies among third and fourth tier cities in China, which are predicted to be future drivers of the Chinese economy. Thus, marketers must look at these cities with renewed interest as most of the younger market, under the age of 21 years old, live in these areas.

Trends and Opportunities

Here are some of the most popular trends of the Chinese online landscape in 2020.

Big Data and Advanced Analytics

Collecting consumer data is no longer a competitive differentiator in China: the country’s digital landscape has come to a level of maturity where strategies driven by big data and advanced analytics are prerequisites for brands to garner valuable insights into the market. This is particularly important for the e-commerce sector. Since online shopping is heavily integrated in Chinese consumers’ online activities, an enormous influx of data is collected and, with the size of the Chinese market, will still continue to grow at a rapid pace. Thus, big data provides a concrete way of addressing the management of these loads of data.

Additionally, a complex online market like China needs these strategies in order for businesses to make sense of its constantly changing online landscape. In harnessing a deep understanding of Chinese consumer behavior, companies must invest in having trends carefully checked and observed by professionals, especially at a local level. These strategies are also applicable to their own online performances in the Chinese market, which should not only be measured but be understood in order to identify weak spots and create better business models.

Advanced analytics can also aid in assessing the effectiveness of the marketing strategies using KOLs/influencers, one of the biggest marketing trends in China, and in the overall ROI. Thus, brands need to consider investing in their own company data, which can optimize personalized marketing.

Source: http://www.chinadaily.com.cn/a/201902/14/WS5c652ef6a3106c65c34e95f1.html

Omnichannel, O2O Marketing

As online shopping becomes a prevalent activity in China, the demand for better online customer experience also increases. Chinese consumers are now accustomed to online-offline marketing, therefore new strategies must be developed to continue engaging the audience. Some of these are posed to be AR and VR, which can transform traditional retail and further strengthen O2O.

According to Totem Media, brands have to create cohesive engagement strategies employed across various channels, both physical and digital, to support sales and longer-term brand building efforts. Especially with the merging of social and e-commerce in China, these strategies are necessary in bringing about brand engagement and identity.

Creating a single, seamless customer experience for your audience will not only generate new business, but also build a positive response that will increase customer retention rates. An omnichannel-driven marketing strategy creates such an experience, which unifies both sales and marketing channels, either physical or digital.

Additionally, this strategy employs a customer-centered design plan, which is also useful in a personalized approach, as omnichannel marketing lets the consumer have the accessibility and convenience of purchasing a good or service on the online market anytime they want. Furthermore, e-commerce channels in China are rich sources for social listening, thereby helping marketers tailor their media plans to create better SEO and other social strategies.

Mobile Marketing

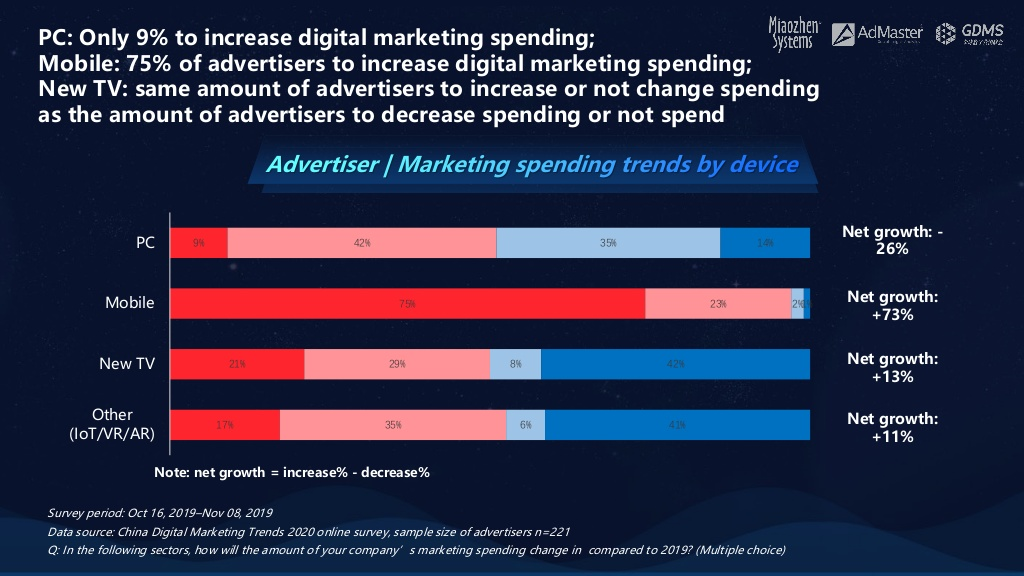

Digital marketing is a booming industry in China. AdMaster reports that for 2020, 71% of advertisers planned to increase budgets for digital marketing. The same data shows that 75% of these advertisers will also be focusing on increasing ad spend for mobile. It is also predicted that with the prevalence of mobile, digital TV will grow and become an important marketing strategy, especially since Chinese consumers spend most of their online activities through watching videos. More than half of these marketers said that their mobile strategies will be integrated with social and video marketing.

There are over 812.6 million mobile internet users in China with 95% accessing the Internet via their mobile phones. As Chinese consumers are mobile-savvy, their preference for conducting online purchases has shifted to mobile as well, such as comparing prices, looking for product reviews, and seeking additional information while in a physical store. Due to this, Chinese shoppers are groomed to find products on mobile that on any other medium.

Source: https://www.slideshare.net/NextRenShanghai/china-digital-marketing-trends-2020

Short-form Video Marketing

Video content is very relevant to the Chinese market, but with certain specifications. For 2020, short-form videos are predicted to become the second most preferred content marketing format in China, with consumers watching an average of 128 videos per day. As such, many apps and short-video platforms are on the rise. The most popular one is called Douyin, or TikTok in the international scene, with a 400-million user base. As of March 2019, Douyin users open the app 8 times a day and spend an average of 46 minutes per day on the app. In 2020, WeChat also added its “share” and “add as favorite” function as a strategy to ride onto the short-video platform trend.

Short-video content must be both relevant and engaging to successfully capture the audience’s attention, a feat that is becoming more challenging with their decreasing attention span. Marketers are using the platform for many promotional materials such as promoting brand culture, product launching announcements, product reviews, and many more. For instance, videos may show a behind-the-scenes look on a special event to reel the audience’s curiosity and gain enough interest to make them wait for the next promotion. But aside from promotion, short videos are also popularly used in China for PR crisis management, improving customer relationships, and market research, to name a few.

The advantage of short-form videos lies in their flexibility and quick production. Also, to further amplify the effectiveness of short videos, brands may collaborate with celebrities and KOLs/influencers, who happen to be producers of the most popular short-video contents.

Most Chinese users that subscribe to this platform come from the youth, particularly the post-90’s generation. Most of the live streaming platform users were under 30 years old. Users aged 25-35 are at 33%. Moreover, most of these short video app users are male at 52.6%, covering more than half of the total number of users.

Source: https://jingdaily.com/short-video-luxury-marketing-china/

Global beauty brand L’oreal banked on this statistic and conducted a Halloween campaign last October 2016 through the platform Meipai. The campaign encouraged female users to upload their make-up videos in exchange for a free gift from L’oreal. In effect, the campaign generated over 60 million views for the campaign videos, with more than 11,000 users who uploaded videos.

Micro-influencers and Key Opinion Leaders

Influencers are powerful game-changers in the digital marketing sphere in China. Known as Key Opinion Leaders (KOLs) in the country, their reviews, opinions, and social networks are heavily relied on by consumers more than the actual corporate brands themselves. Chinese consumers do not trust brands easily due to the many issues and scandals that have surfaced over the years, which is why they turn to KOLs to deliver authenticity.

Research shows that consumers respond more positively to campaigns involving KOLs. They are not just internet celebrities, but also columnists, socialites, photo bloggers, and content curators. They appeal to their audiences through an image of authenticity and relatability, from which a personal relationship with their fans is built. However, it is important that brands choose the right KOL to effectively deliver the intended message and value of their campaigns.

Additionally, KOLs can better reach China’s complex and dynamic market. With its large market size, consumers per region have different trends and needs that creating customized strategies to cater to these would be too time consuming and expensive. Thus, marketers can use local micro-influencers who are already in touch with the trends of a particular region, as well as have a solid and loyal following base there, to become instruments of delivering their campaigns successfully. Also, they can produce content at a much faster pace while being in sync with the ongoing trends within their region.

KOLs also provide a way for marketers to reach audiences within major channels that they cannot directly optimize. For instance, WeChat is a difficult platform for brands to gain visibility because the app does not allow links from external websites. However, there is a thriving community of influencers on the app that marketers can use as a way to reach WeChat consumers. The merging of social and e-commerce in China has led Chinese consumers to subscribe to social commerce. For this reason, influencer marketing is no longer considered just an option, but a necessity.

Conclusion

China holds a large and diversified market that needs specific, consumer-centered strategies. These strategies must also be flexible enough to cater to new technologies, such as AI and big data. Other digital marketing developments that can greatly benefit your consumer are big data analytics, O2O marketing, mobile marketing, short-form video marketing, and collaborations with micro-influencers and KOLs. With the help of these strategies, brands will be able to optimize their marketing campaigns and attain success.

Talk to us at Info Cubic Japan today to learn more about online marketing in China.

Featured Photo by Adi Constantin on Unsplash